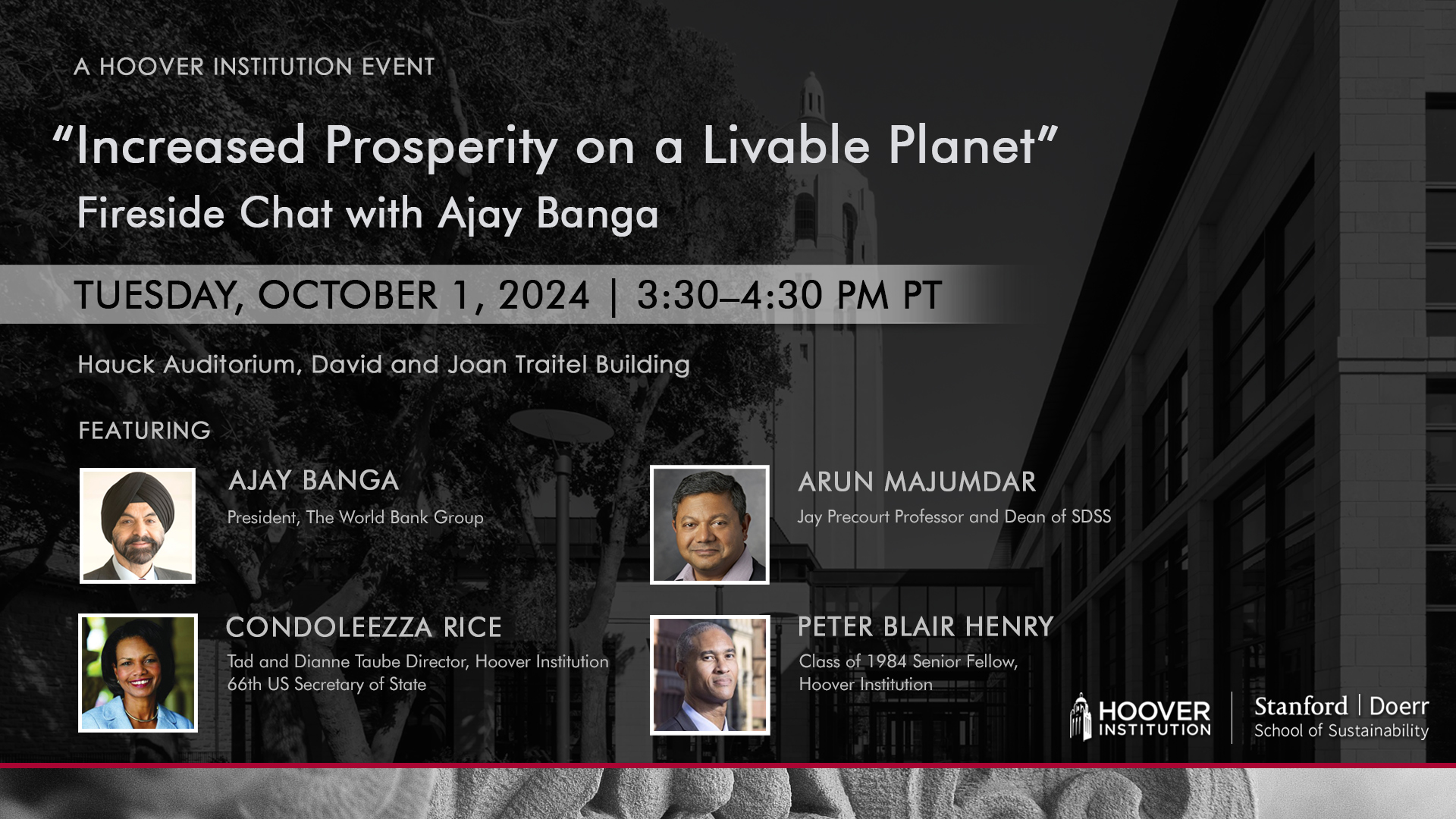

A fireside chat with Ajay Banga, President of the World Bank Group on Tuesday, October 1, 2024 in Hauck Auditorium, Hoover Institution. Doors open at 3:00 pm PT.

Condoleezza Rice, Director of the Hoover Institution and 66th US Secretary of State, Arun Majumdar, Jay Precourt Professor and Dean of SDSS, and Peter Blair Henry, Class of 1984 Senior Fellow at Hoover, conduct a fireside chat with President Banga on the importance of the World Bank leading "informed risk-taking" to catalyze blended (public and private) finance to fund investment in development and accelerate the energy transition.

>> Condoleezza Rice: Welcome to the Hoover Institution here at Stanford University. This is a big ideas lecture. It's a fireside chat with our wonderful guest, the president of the World Bank, Ajay Banga. It's organized by colleagues of the Doerr School for Sustainability and the Hoover Working Group on emerging markets.

The term emerging markets actually didn't exist in 1944 when world leaders gathered in Bretton Woods, New Hampshire, to create a framework and institutions to rebuild international economic cooperation. The demise of that cooperation was actually the root cause of the Great Depression and World War Two. Since then, one of those institutions, the World bank, has played a central role in making the economic case for free rules based movement of goods, services and capital across borders.

This rules based international order, globalization, as it sometimes has been called, has lifted more than a billion people out of poverty since the fall of the Berlin Wall. But of course, it is under question. It is under threat. And I look forward to the discussion of how we reinforce a rules based economic world in which growth can continue.

Now, there is no greater demonstration of the power of harnessing markets to increase human thriving than we have seen in the last decades. But there are so many challenges to that hardware and progress brought about by the global commons. Economic growth has slowed, debt crises abound, and even as people in emerging economies seek more energy to power their production, to light their homes, to educate their children, we and they are challenged by climate change and environmental sustainability.

These are areas of the world that sometimes do not have access to the new technologies that may indeed hold the answer to some of these challenges. I look forward, as I'm sure you do, to hearing our colleagues talking about how to deliver increased prosperity to a livable planet.

Ajay Banga is the 14th president of the World bank. He's the former president and CEO of Mastercard, a global organization with nearly 24,000 employees. Under his leadership, Mastercard launched the Center for Inclusive Growth, which advances equitable and sustainable economic growth and financial inclusion around the world. At its inception in 2021, Ajay became an advisor to General Atlantic's Climate Focused Fund, BeyondNetZero.

He is the recipient of many honors, too numerous to name the Foreign Policy Association Medal, the Padma Shri award from the President of India, the Ellis Island Medal of Honor, and the Business Council for International Understanding's Global Leadership award, and the distinguished Friends of Singapore Public Service Star.

These are just a few of the honors that demonstrate his impact on the international system, on peace, and especially on prosperity for people across the world. He will be joined in conversation with Arun Majumdar, who is the inaugural Dean of the Doerr School of Sustainability and the J Precourt Provostial Chair Professor.

He is also a senior fellow at the Hoover Institution and Peter Henry, the class of 1984, Senior Fellow at the Hoover Institution and Dean Emeritus of the NYU Stern School of Business. Please join me in welcoming Ajay Banga and our two Stanford, I almost said interrogators.

>> Condoleezza Rice: Conversationalists.

>> Condoleezza Rice: Thank you.

>> Peter Henry: Thank you, Condi, and welcome, everyone. Ajay, special thanks to you for being at Stanford, but also for taking on these enormous challenges that you agreed to address in your new role. It's good to see you again, my friend.

>> Ajay Banga: Thank you, it's really nice to be back in Stanford.

My daughter graduated from the Graduate School of Business, so it's good to come back to campus. Kinda excited you to see the place again.

>> Peter Henry: So let's jump in. You've been in the job for a year now, and when you started in 2023, you outlined a set of reforms that you thought would make the bank more efficient, better use of its resources, simpler, faster, and a better service to its clients.

So how's that gone? What are you most proud of in that year, and what's left to do? What needs to be done?

>> Ajay Banga: Plenty left to do, the institution has an ATO history, as you heard secretary Rice talk about, and it's done well, but it also, therefore, has built ways of working that need to adapt and adjust to what's going on in the world today with the way geopolitics is going, or what I call the set of intertwined challenges that our generation, and the generation in this room, younger people as well, face.

And that is the issue that dealing only with poverty or the spreading of prosperity is inadequate to do, unless you understand that it's impacted deeply by climate change, it's impacted by fragility, conflict, and violence. It's impacted by pandemics, it's impacted by food insecurity. And so trying to put these into neat buckets and deal with them separately is not gonna work.

And so the idea of saying we're in the business of eliminating sort of poverty, but on a livable planet, was to expand the aperture of the way in which we and our partners looked at the issue, to say, there are some problems that are across the world. Whatever is locally applicable in this country, is it a climate disaster?

Is it fragility, conflict, violence, is it refugees, is it a pandemic? Whatever is applicable to us that affects the quality of life and affects the livability on the planet of people, that's what we've got to focus on. So rather than straight jacket ourselves into one cause or the other, we're trying to actually address the spectrum in a sensitive way, that's kind of the big picture of what's going on.

To get that done, we had to redefine, obviously, where we were going. And I put into it a focus on women and young people. Women, because they're half the population, and in the emerging markets, the developed world, they don't get a fair shake on everything. You look at the funding from Silicon Valley that goes to venture capital into women-started businesses, and it's not a number to be proud of.

So when you go out of countries that are at least better developed, you come to the emerging world. It's a much bigger challenge for women. A number of places, they don't have the legal right to work, they don't have the ability to own assets in their name. The system is stacked against them.

And so trying to find a way to break through that is kind of, I think, a serious priority, both in terms of helping them, but most importantly, unlocking the productivity they can bring to an economy if they have a. Have a fair chance. The same thing with young people, there's 1.2 billion young people coming through the labor force readiness kind of number by the next 10 to 15 years in the emerging markets.

And currently those markets are on a pathway to generate 400 odd million jobs. And you might be wrong by 100 million here or there. The problem is it's a very big gap between the numbers coming out of and what kind of productive opportunities they could get. And what I believe that's a big issue because you'll end up with migration, social challenges of all times, you'll end up with difficulties in countries.

On the other hand, if you can unlock that opportunity and give them the right and the dignity of having the chance to have a job, then I think you can create a productive growth model for the world for many years to come. And so both of these are a challenge and an opportunity.

And resting all this on the better bank was kind of to meet table stakes. If you don't fix the speed at which the bank turns things around, if you don't fix its ability to work as a better partner with other institutions, because the task is big, the numbers required are large, and we're not gonna do it by ourselves.

So the idea of being one plus one equal to three with partners is kind of important. And I think getting all that to work better silos in the place, the stuff that makes for the engine oil to keep an engine running well, that to me is table stakes.

Everybody's attention is focused on that, I believe that's just, I got to get that done so we can keep going onto the bigger issue of livable planet women and young people, which is where my focus is right now. For the plumbing, as I call it, the plumbing, which is the basics of getting it to work well, it used to take 19 months for a project to go from the first conversations in a country to its approval in our board.

We're down to 16, we're headed to 12. We're probably unlikely to get below 12, although I would like to, because most governments I'm dealing with, if they're democratically elected, have a 4 to 5-year term. If you spent two years getting a project discussed, basically in that third year, they're not interested in you any longer, and that's such a loss of opportunity.

So getting ourselves to the stage where we can get things out the pipe quicker is kind of important. It's not just the approval, it's the capacity at the other end to then implement such a project. If those countries had the capacity they probably would not be in the situation they are.

And therefore, finding a way to enhance their capacity with our people and divert our resources into that is the second big task that's underway. The third big task is to sort of work much better with all the other multilateral institutions, but also with the private sector. And hopefully we'll discuss that as we go along.

And the last piece is, I believe while everybody thinks of us as a money bank, we kind of got five sub institutions that essentially are financial in nature. The real fact, what we actually are as a knowledge bank, what we really bring to countries is expertise and knowledge in everything ranging from jobs and water and infrastructure, and digital, and education and skilling.

And using those people, the knowledge bank, in a way that makes it easier for countries to engage with us and understand us, and for civil society to work with us is kind of important. And so I've taken the knowledge bank of people and put them into five groupings, people, prosperity, planet, infrastructure and digital.

And I pulled digital out because it impacts all those four, but it's such a game changer pitching the converter in Stanford, but it's such a game changer that it cannot get buried into any of the other verticals. So people is health and education, social benefits. Prosperity is trade policy, economic policy, domestic resource mobilization, financial inclusion, credit for small businesses, all that.

Planet is water, air, food, biodiversity. Infrastructure is what everybody knows. And then digital is everything to do with digital public infrastructure, but also data and analytics and AI and ethics and governance. That's what's going on.

>> Peter Henry: How much?

>> Ajay Banga: It's wet paint, a lot of this is wet paint, and I can't wait for the paint to dry so I can get going on the really big issues of livable planet and women and young.

We've made a few commitments, Peter, in the last year, that I think are forcing us to change as well. And I believe in doing that, you stick something on the wall there and people tend to focus on it. And so one of the things we stuck on the wall is to get 300 million Africans connected to electricity, renewable electricity, by 2013.

And I hope to talk about that. But another one is to connect 1.5 billion people to primary healthcare in the coming 7 years. A third one is to take 45% of our financing into climate by 2025 next year. And so there's a series of these somewhat large commitments that are forcing all of us to have a north star to go towards, and that north star connects to the idea of women, young people on a livable planet, that's the idea.

>> Peter Henry: We'll get into it, and I know that my colleague Arun has a number of questions related to some of those issues you've already raised, so I'll let him go with the next question.

>> Arun Majumdar: Well, Ajay, thank you for joining us.

>> Ajay Banga: Interrogator number two.

>> Arun Majumdar: I just learned about your travel schedule, and so I really appreciate that you and Ritu came and joined us over here.

Lemme go back, you gave a speech last year, round about this time last year, which I got a copy from Steve Denning, who was general Atlantic and of course, Stanford connected.

>> Ajay Banga: What the hell was Steve doing with a copy of that?

>> Arun Majumdar: I don't know, he gave me, he said, you got to get Ajay to Stanford, and so that's how it all started, and with Peter and Condi.

So I just want to go to your speech. And you defined the mission, you organizing the World Bank in five verticals, people prosperity, planet, infrastructure, digital. And eight global challenges, adaptation, mitigation, fragility and conflict, pandemic prevention, preparedness, energy access, food, nutrition, security, water security and access and enabling digitalization and protecting biodiversity in nature.

This is almost the same mission as the door school of sustainability. So this is great, I mean, in terms of resonance. Talking about climate change, next year will be the 10th anniversary of the Paris Agreement. In the COP 30 in Brazil, all countries are supposed to go with a plan of the transition plan.

And each country is starting from a different initial condition, different constraints, different boundary conditions, etc.

>> Ajay Banga: They all had their nationally determined contributions.

>> Arun Majumdar: Exactly, so if you step back for a moment, from your perspective, how's the world doing? Are we on mark or are we missing?

>> Ajay Banga: No.

>> Arun Majumdar: So we have asked-

>> Ajay Banga: That's a short answer.

>> Arun Majumdar: That's a short answer. So we have asked 170 or 190 odd countries to come up with a plan, but really, the G20 is where the main emissions are coming from, whereas all the rest of the world has to look at climate adaptation, etcetera.

So are we putting the burden on climate change on those countries that are not contributed, did not contribute to the emissions? And if you are to revisit this, and how would World Bank look at this and say, okay, this is the way it ought to be.

>> Ajay Banga: I mean, there's so many issues in this question, right?

So, first of all, there's the issue that, to me, the Paris agreement. It's a bit like putting that thing on the wall out there. You put something and people go towards it. What the Paris agreement has got people to do is four or five things that have worked very well.

And the first one is a much higher level of awareness, not just in governments, but also among people, of the importance of this topic. We all forget this, but go back five, seven, eight years ago, and this was not a topic that people understood or discussed. I still think the topic is discussed in a way that confuses the average person.

For example, if we spend all our time discussing carbon taxes and carbon pricing, that's interesting. But what an individual cares about is, if I take the subway instead of a cab, does that equal to planting a tree? If you can make that equation work in their minds, you will get their hearts and minds behind the fight as compared to, this is somebody else's discussion.

And I'm a passenger, and all I'm being told is the way I'm leaving my life, I cannot lead. And therefore, you're gonna make me do something that I don't want to do. That's not a way to win hearts and minds, but the idea of getting engagement and awareness, we've done really well.

The second thing that's done well is if you think about solar energy and wind, the capacities have gone up tremendously. The cost has come down tremendously for various reasons, scale and technology. But, I mean, we now take a day to install a gigawatt of solar. It used to take 100 days just a few years ago.

Capacity in solar is growing 25% a year on the average, for the past decade. And by the way, in the last year, it's doubled, right? So if you think about that, this is headed in the right direction. It's not headed evenly in the right direction, but it's headed in the right direction.

So cost, capacity, awareness, much progress, where we've got challenges is on three or four fronts. And the first one is the fairness, as the emerging markets would say, which is that you guys led this life using emission-heavy energy to create your life. And now, when it's my turn, you're telling me I can't use it.

And you, therefore, will instruct your banks to nothing fund my ability to explore even natural gas, which, by the way, is what you use all the time. And you, America, are the largest exporter, and you, Europe, are actually surviving on it. And to be completely clear, why shouldn't I then have it?

That's the nature of that discussion, and there is logic to that discussion. The problem is if you tell them you should go to solar and win, that doesn't make a lot of sense because the variability of that production means that in any country, you need base load. And the base load gives you the standard energy you need to run, and then you can have the ups and downs caused by solar and wind, as you know.

Well, the question of the base load then comes back to, where do you get that from? It's either from hydroelectric or geothermal or nuclear on the renewable side, or it's on fossil fuel. And that's the issue that they're arguing about. That one has not been well handled. The second part, that's not because transition plans are not well understood in society.

It's almost like a tap that you turn on and off as compared to a transition plan that allows you to go there. Second thing that's not being done very well is methane. Methane is 20 times more dangerous than carbon dioxide. Everybody only discusses carbon dioxide. 2% of climate financing is going to meet him.

That is just completely crazy. And we think about that and think about it well, and there's a lot of work we're trying to do on that front. The third one has to do with what I call the unfortunate aspect of carbon credits not yet being certified in the right way, trustworthy enough to create the actual movement of money from the developed world into the developing world to fund some of this.

To believe that you can tax a citizen in Minnesota to send the money to South Africa is a pipe dream. There is no politician who is gonna get that done. And so we have to find a more sort of a more voluntary way of making this money move.

The best way to do it is through carbon credits, which then are purchased to offset what you're doing. The problem is, if these carbon credits are greenwashed, which has happened, and there's no certification method, and there's no registry. And a number of countries don't even know how to track them, well, then you have a problem.

And again, there's a series of things we're working on to try and stabilize the carbon credit market in projects where we're involved, particularly in the case of forestry, is where we're starting. So we will certify the environmental integrity of the credit, meaning you can't cut a tree down here to plant it here.

And second, certify the social integrity of the credit, meaning the money goes to the community and not to the government. Because then, if you don't give it to the community, the moment you turn your back, they'll cut the tree down again because they're cutting it for survival. They're not cutting it to spite your face.

So you have to give them a reason to not cut it down. And the only way you can do that is through economic logic. And so if you go to visit mangrove plantations, we're working on in Indonesia, effectively, the families of the fisher people, the fishermen, no longer have to go as far to fish, that's great.

It's the women who are getting all the benefits from the mangroves as well. In addition, from the chips they can make and sell to the ink they extract from the batik they can produce, and so on. And so they are in it, along with the men. And that's what's enabling the community to keep those mangroves going.

So there's a series of things that have not been done well in this space. And to me, the biggest problem is the last one, which is even if you get everything right on electricity, which is where all the focus is. The reality is you've got to solve heavy transport, we've gotta solve construction materials, and we've gotta solve agriculture.

And if you do the math and you look at the Potsdam Institute's graphs and numbers, basically, we're not gonna win this battle in a hurry. Therefore, carbon capture becomes critical-

>> Arun Majumdar: From the atmosphere.

>> Ajay Banga: Absolutely, not just carbon abatement at a plant, but carbon capture is gonna become critical.

The problem is, the public debate right now is if you start doing carbon capture, are you giving a cop-out to the fossil fuel companies? And I think we have to move this debate into science and not into emotion right now. And the science will tell you that we are gonna need to be firing all bullets in our gun if we are gonna get this right for our children.

And therefore, simultaneously working on electricity, but also construction and heavy transportation and agriculture, and carbon capture. We don't have a choice. It's kinda what we need to do. That, to me, is not currently a fully appreciated conversation. There's so many aspects to your question that it's complicated. So the way I think about it is pick off bite-sized chunks that you can make a difference to.

And one thing I'm focused on is that carbon credit piece. Where we're involved, not only are we doing these forestry credits in 15 countries right now. I think I can generate 125 to 150 million credits from those countries alone, just forestry. But I'm also working to help create a carbon credit registry with the government of Singapore and working with 30 countries to teach them how to track carbon credits and do them the right way.

So we can start building this ecosystem, then maybe we can get voluntary carbon credit To go from a ridiculous pricing today of 6, $5 a ton, even 20. Forget about the 40 and the 80 that people estimate is an appropriate price, or the 120 that some think is an even better price.

Just from six to 20 would make a large amount of money move. That's one topic. And so on. Methane, they're making an effort to get. If you look at rice, I don't know how much time you got. We can discuss this a lot. But if you look at rice, when I grew up in India, you grew rice by flooding the field and left it flooded until you harvested.

That's one way of growing it. Mostly that's done because the farmer doesn't believe the water will come back again in that period. In reality, if you were to let the water drain away after the planting and then irrigate periodically and then reflood one week earlier, you would actually reduce methane from rice by 40% to 60%.

And methane from rice is 8% of all the methane. And methane is 80 times more dangerous than carbon dioxide. And this is not rocket science. This is proven. We've done it in Vietnam with 600,000 hectares. We're going to a million. There's no reason why you can't do this in ten countries, or with how you manage organic and inorganic waste, which you run pilots in Brazil.

Lighthouse projects that show you can reduce the outcome of the methane from waste by enormous amounts by doing this. Or through simple pills in the diet of cattle, which changes the outcome, but also improves the milk outcome so that farmers have an incentive to be a part of this.

You have to find a way to make all sides of this balance sheet work. And there's work going on in our front in all of those.

>> Arun Majumdar: I wish I had half a day for you to spend some time with the door school, because a lot of these things are very common issues that we're dealing with.

But I'm gonna hand it over to Peter.

>> Peter Henry: I wanna go deeper on something you've alluded to. So you talked about infrastructure and the importance of infrastructure. You also talked about the importance of private money because of the capital constraints in the World Bank. So you've started this private sector lab to look at this issue of how do you get more money to flow from developed markets to emerging markets to privately finance some of these public infrastructure projects that are so critical?

What have you learned from the conversations you've had over the past year with the private sector lab? Where are you in that process? How hopeful are you about unleashing that capital? What else needs to happen?

>> Ajay Banga: Yeah, so the issue, this is focused on renewable energy in the middle income countries.

That's where we started.

>> Peter Henry: Okay.

>> Ajay Banga: Because the idea was that the principle behind it is that no matter how much work we do in the developed world to move. Europe right now, its biggest savings in emissions come from moving from coal and thermal and diesel to gas right now.

But they're putting up a lot of capacity in wind and solar. So hopefully, over the coming years, it'll be further enhanced, that movement. The US is doing pretty well on that, too. The problem is, all that you save here will get burned through and much more. But the natural growth of the middle income countries in terms of their energy consumption, as prosperity and populations grow in those countries, it is their time of providing growth for their citizens.

So this is going to happen. And I think if we therefore don't find a way to turn the tide, to bend the curve, as you would say in my old life in banking, to bend the curve in those middle income countries. Then I think we lose this battle even on the electricity part of those four or five things we were discussing, right?

That's the issue. The dollars required are in the trillions in a year. There is no way that balance sheets from people like us or governments will fund it. We have to get the private sector in. The good news is solar and wind is now proven per unit, particularly onshore wind is proven to be lower per unit than fossil fuel.

So then why is it that there aren't people beating the doors down in these middle income countries to put up solar and wind plants in an effort to make money from it, which is what they should be doing. And the reason, it turns out, from this lab, very clearly, there are four big reasons, and a fifth one, which is actually quite interesting.

The first one is an absence of clarity on regulatory policy, tariff policy, the principles of where a country is going. There's no way that an investor will put money to work if they don't believe that the policy they're being told that a country will implement is something that's actually gonna get done.

And if you therefore ask me to put a billion dollars to work, given that the IRA has produced great financial incentives to invest in a country with a, as of now, relatively predictable regulatory environment, then why would I go and take that billion and put it to work in a country like Indonesia or India or Brazil?

That's the first issue. It is actually issue number one, two and three for most private sector investors. One of the things we're doing with this Africa project of connecting 300 million people out of the 600 who don't have access to electricity to power, is sitting with 15 heads of state on January 27 and 28th next year in Tanzania, in front of a bunch of private sector investors and people like us, and agreeing on an energy compact by country, which includes what changes they will make in policy and what incentives we will give them to do so if they do it.

Meaning, a pay for results program, where I give them budgetary support in return for enacting the regulatory reform that will allow a private sector investor to feel that the utilities will be capitalized, and so on, and so on. So that's the first item. The second one is, even if you get that, they want political risk insurance that we can do.

We actually sell political risk insurance through one of our five verticals. We sell it in different places. We're trying to put it all together, simplify it. That's the better plumbing thing. It's already growing. It's grown in the last year that I've been there by 100% in size. I think we'll double it again in the coming two years.

And so I think there is a real opportunity to improve that political risk insurance. Effectively, we give you that risk insurance and then we reinsure it to the private market. But because we are what's called a preferred creditor, meaning, we always get paid back. And the reason for that is if you don't pay us back, nobody's gonna give you money again, that's it, you're closed.

So every country, even in the most dire circumstances, will eventually find a way to repay us. And therefore, the insurance market for things we are involved with is priced better than you would get as a company on your own, no matter who you be. And that's the arbitrage that we can bring to the party.

The third aspect they want is that we, particularly in our private sector arm, the International Finance Corporation, should take first loss risk. So if an investor is stuck trying to figure out how to make this profitable on their spreadsheet, and I take first loss, it'll put them over the edge in a good way, not that way.

And so the problem with that is it makes all the sense in the world until I actually have to book the loss. If I end up booking losses, either because first loss comes true, or because I do much more equity lending rather than debt lending, I'm using the word lending loosely, then I am subject to gap accounting, which means every quarter I have to take a mark to market on my equity book.

And therefore, that introduces volatility. My funding comes from sovereigns. Sovereigns detest volatility. And the idea that they would have to refuel my capital if I go through a year like 2008 or 9 or one of those, that is anathema to them. They and read the public debates. There isn't a lot of fiscal space in the rich world right now to refuel capital.

So that's a challenge I need to surmount, hopefully, with philanthropic capital as well as retained earnings of our own, can we create a shock absorber to absorb these movements? The fourth item, even if I do all this, is foreign exchange risk. That one is the hardest. Anybody here who's worked in a bank and the like, if you believe you've figured out how to solve foreign exchange risk, I will bow down to you and hand over my job to you.

Because I worked in a bank for many years, and the people who tell you they've cracked the code are the ones you should run the furthest from. Because foreign exchange is inherently a very complicated game. And in this particular case, it's even more so because you're lending money in 30-year, 40-year projects.

There is no 30 40-year hedge for the Indian rupee. There isn't a 30 40-year hedgehead for the euro, let alone the Indian rupee or the Indonesian rupee, or the Brazilian real. So how do you get people to invest capital, which is going to be locked up for 40 years or 30 years.

And get paid back by tariffs and local currency, and expect them to sit unhedged on that difference? Now, there's ways to do it. We're trying to do a multi-layered risk approach. I'm trying to approach banks in these countries that are surplus in local currency, which most of them are, and they pocket with their central bank for a very small spread.

Give that to me, and I will lend that to these project doers and so on. There's ways to try and do this, to solve it. There is no this way to solve foreign exchange. And then the last one, which I think is the most exciting, is how do you really get pension funds and asset managers to bring trillions to work?

The only way you can really do that is if you give them packaged loans, which add up to sizeable enough numbers to move the needle for them. So if you went to Blackrock or to the Ontario Teachers pension plan, or your University of California plan, and you said, I could give you $5 billion of exposure to water in Africa, here are these 20 loans.

They're kind of standardized in their covenants, they're kind of standardized in their pricing. They're packaged together and certified with a rating from a rating agency, you will begin to get that interest. But if you come to them the way we do today, which is here, are the same 25 loans once for 22 million, once for 37, once for 100.

They're in 20 different countries with different covenants and different pricing. Please underwrite each of them individually and take them off my balance sheet. That is not going to work. It just does not. And so, creating scale and standardization is the most interesting one to me. And there the good news is - I've just had an agreement with the CEO of Standard and Poor's to lead that effort for us.

That if he, along with BlackRock and a few market making banks, if they can help me figure out how to crack this code. It will require work on our side, but also on the receiving countries to not be so rigid about every covenant and every rule. They would be willing to do that if I give them some incentive, lower pricing, more liquidity.

So there's work to be done here, but this I know how to do. If I can get it going over the coming years. This is the one that will take three, four years, but this is the one, the biggest payoff. So these five things are being worked through.

It's gonna need determination, it's gonna need philanthropic money and our own reserves to be able to take certain kinds of risks that we haven't taken in the past. But these are all doable things, and this is just renewable energy in the middle income countries, there is more that can be done with other areas, like methane and so on.

>> Peter Henry: Well, you have no shortage of determination. Before I turn it back to, if you could just speak relatively quickly about something you've very, very focused on. Which is how do you actually get your employees to focus on driving the outcomes related to, for instance, those five particular pillars that you just mentioned.

How do you do that?

>> Ajay Banga: For very good reason. Over the years, the bank has focused on, not just us, all multilateral banks at the time focused on input rather than output. Meaning how many projects, how many dollars, and the good reasons are numerous. That's another day's conversation.

Most of it has to do with the governance model created by the way in which our shareholders operate. Some of it has to do with culture inside the bank, which is fed off that governance model. To change that, from how many projects and how many dollars to how many girls went to school because of the project you funded.

Or how many people went to the skilling institute because of the project you funded, or how many carbon tons of emission you avoided. That's the output. The real measure I would love to get to is outcome, which is how many girls who went to that school ended up with a better life at the end of 15 years because of the education you got, right?

That's what you developed for measuring. That last one is very squishy and very hard and subject to all kinds of greenwashing. But the second one is not. It's objective, actual facts and numbers. We have changed our corporate scorecard, which was 152 items when I joined to 22. And I laughed when I first joined.

I even told the board if I was in the corporate sector still and I had a scorecard on my board with 150 items, I would always get an a because I'll find the 40 in which I knocked the ball out of the park. You'll never get me to talk about the other 110.

You'll never get me there. I'll just keep talking around you nd so this is nonsensical. We came down to 22 items and they're all output oriented items. We're changing all our measures over these coming two years to change from input to output. Some are already measured and published.

I will publish these to civil society and the public so you can hold me to task on these 22 items and how I measure them. So output, not input.

>> Peter Henry: Over to you.

>> Arun Majumdar: So just so you know, we did have a tag team on the interrogation that Connie talked about.

And so we have a little follow up on some of the things that you have said in terms of your plan. One is the livable planet goal, and this is a major issue for you. I have two-part question. One is when you are defining livable planet, there needs to be some valuation of what the planet is.

We know how to do GDP. We don't know how to and that's the valuation of the economic valuation. There's some work going on out here, really amazing work. The natural capital project on valuing nature. Is there some metric that you're using on how to value nature so that you can actually invest in that regard?

>> Ajay Banga: No, not today. Not yet. That doesn't mean it shouldn't be, but not today. Only because the acceptability or the actual calculation of that metric is still at such early stages that. Getting governments and sovereigns to commit tons of money based on evaluation that is unacceptable to everybody will never work.

The thing about GDP is that everybody understands it and accepts it. If you remember when purchasing power parity came, it took years for people to embrace it. And even now, everybody argues one day for it, one day against it. And so you got to have in our business, because at the end of the day, we are reliant on the funding from a lot of countries for the money to go to a lot of others.

And for them to divert taxpayer money and their budgets. Into doing all this, you have to create measures that aren't controversial in the measurement itself. Otherwise, you create just enormous angst in getting your work done. So I'd love to get there. And if guys like you all can actually develop this and work with us on things of this type, and we can start creating a public forum where they get discussed, where they get parsed and looked at and they start becoming acceptable, you would enhance our work many times overdose.

>> Arun Majumdar: So we will follow up with you on that, because there's a whole concept of gross ecosystem product, which is on looking at how to value ecosystem services.

>> Ajay Banga: There's a lot of this. There's a lot of things that the bank should do with universities like yours, in many ways, not just your school, but I was discussing this a little while ago.

But if you look at fragility, conflict and violence in the world, it is spreading at a rate that is very unfortunate. Today there are more than 100 million people living in some form of refugee status. More than that, I'm not counting the recent ones in Gaza and Lebanon.

That's gonna add to the number, 100 billion plus. The average refugee is in a refugee state of mind for 16 years, 16. 16 years you will have children, your parents will die, your kids will graduate from school, events will happen in your life. This is not a one two year thing.

This is a 16 year refugee state of mind, which means you cannot plan for your future for 16 years. That is how challenging it is. 28% of our money is going into FCV affected countries. It's burning through what I could be able to put to use to real development, because delivering development in a fragile country is very hard and very risky.

Therefore, getting to predict fragility, or the likelihood of fragility five years in advance as compared to six months in advance would be a good thing. There must be a hundred different indicators that can be used to start thinking about that. How many young people aren't getting a job?

Corrupt leadership, climate events, escalating gender violence, a difficult neighborhood. I could list like this a number. If you start creating that and using the data to create algorithms and indices that could help us think five years in advance, or a simple red, yellow, green traffic light system to start putting energy to work in two countries five years before they get hit.

Even if we win in two out of ten, we change the world for those two. Those are the kind of things that I'm trying to get at. That's one of the reasons why I'm here today to talk to you. But also to pursue, if this is the kind of thing universities in a bank can work together on and bring objectivity to the discussion and create a public platform for that conversation.

>> Arun Majumdar: If I could just follow up, quick answer. Most of the people, population of the world are going to live in cities. Cities are, as you know, in the developing economies, they grow organically with not much infrastructure, whether it's energy, water, sewage and all of that. And those are the cities that are gonna be face the brunt of the climate issues in terms of heat waves, floods, humidity waves and drought, etc.

So as you look at the development of cities, how is World bank thinking?

>> Ajay Banga: There's a lot of work to be done, just so you have a statistic that will scare you a little bit once. And while you're gonna get scared of this, in the last decade, the population growth in cities has been such that it has grown in the fragile part of cities by 125% and in the safer part of cities by 80%.

So not only is this a problem, it's getting worse, right? Because you just look at our own country here and look at the growth of Florida, and I'm not talking. This is not politics, this is reality of floods. You look at famer zone one, plot it in Miami and look at where the constructions are, and then you've got to ask yourself, what the heck are we doing?

So that's the problem. This is not a question of what goes on in Ceylon or Sri Lanka. It's what goes on here, too, right? So for a minute, let's discuss Sri Lanka. So Colombo was preparing an urban plan four or five years ago, which would have essentially devastated the sink that could absorb water and replaced it with lots of concrete and made it look like Houston.

Which is why whenever it rains in Houston, it floods because there's no way for the water to sink. Once we worked with them in the last year, they changed the plan effectively. What would have absorbed 27,000 Olympic pools worth of rainwater has been salvaged. 27,000 Olympic pools. That's one city.

The thing is, you've got to do this in 50 or 60, one. Second, we have to ask ourselves whether urbanization is the panacea for everything that we used to think it was, where the inevitable movement towards urbanization was seen as the best way for development. I think that just needs to be thought through a little bit.

The Chinese government is actually rethinking their growth model because of that. One of the things, they've got many other things they're thinking on this particular one is the idea of can we deliver development in rural areas in a way that does not require citizens to think that they have no future unless they come to the big city.

I think thinking has to begin also about that kind of work. But you asked the question about the first part and I'm answering the second part too because I think you've got to do both.

>> Peter Henry: So I know there are some questions back and forth in the audience, so I would ask you if you have a question, please come to the microphone.

I know there's some online questions that are also submitted in advance to a run. While we're waiting for the first question from the audience, just very quickly, jobs, your ultimate metric. How are you driving the focus on jobs in particular in Africa where the labor force is gonna double in the next?

>> Ajay Banga: Africa is the single biggest challenge right now in jobs. Although there are challenges in India, there are challenges in different parts of the world. First of all, we've created a jobs council which is just starting off. It's gonna be led by President Parman of Singapore who has got permission from his government to do so while serving as the president.

And by the retired president of Chile, Michelle Bachelet and a group of economists and CEO's and civil society to help create lighthouse projects for us that we will test. But we think the jobs will come in Africa specifically in six areas. The first one is infrastructure, the construction of it, but then what it enables.

The second one is in healthcare. Again, the construction of primary health centers, but then the jobs for nurses, medical technicians, PPE manufacturing, medicine, manufacturing, that kind of thing. Third, agriculture is a business. Africa has land and water, but irrigation is only 6%. Cambodia and other countries which are not the most developed in Asia are 37% and they don't use the right fertilizer and their output per hectare is one third that of what you get in Asia.

So there's work to be done there. You need agricultural warehouses, all that. Fourth is probably will get a great deal of benefit out of manufacturing for local consumption. Plus Africa is gifted with rare earth And minerals for the energy transmission. And that one, if we get to value added extraction and value added manufacturing and there's something there.

And then the last one is probably all this cannot be done without electricity, back to our 300 million.

>> Peter Henry: Yeap.

>> Ajay Banga: Not only that, what we're doing when we're doing the 300 million with each solar distributed plant we install, we're gonna install a cell phone tower. So that in these coming seven years, not only will I connect 300 million people to electricity, hopefully I'll connect them to the Internet as well, and that'll enable the delivery of services.

So, there are specific things we're focusing on to both enable and create jobs.

>> Peter Henry: Thank you, Ajay. So, young lady on the right and then we'll have a run and read a question from the pre-submitted questions, please.

>> Speaker 6: Ajay, thank you so much for coming today. My question is, what do you hope for the World Bank's role in AI governance, in ethics?

>> Ajay Banga: So, very early stages on AI for us, because we were really not active in that space. In fact, we were less active in digital as a whole than we should have been. But we have activated a lot of work on digital public infrastructure, we're just getting going on the AI space.

What I want to do with AI is to first create a set of a way for a public dialogue to happen, using us as conveners to enable the right thinking around the ethics and use of AI. Otherwise, every government is trying to do on it's own and that's a little nervous to me.

The second is far more scary, once in a while, being scared is a good thing. This is one of those people have managed to convince the emerging markets that AI is the answer to their future. I actually think it's gonna be very challenging, cuz what you need for AI are four things.

Computing power, lots of electricity, lots of data kept in it's simplest safest form, and people who know how to manage that data and use it. Most emerging countries, most have none of those form. And so, even if it takes them ten years to catch up, ten years in AI terms is 100 years in normal life.

And so I'm quite concerned that we have to find a way to help bridge this gap for them in the coming period and I don't yet have a foggiest idea of how to do that.

>> Speaker 6: Thank you.

>> Peter Henry: Arun, you wanna give us one of the questions that came in?

>> Arun Majumdar: So, we have ten questions we're now gonna ask, but maybe ask two of them. With geopolitical tensions this is from Ignacio Sabati geopolitical tends to rise. What role should the World Bank play in United Nations around common development goals? That's question one, a quick one from Sanjeev Khagram.

Carbon removal, as you mentioned, is a multi-trillion dollar industry. How is the World Bank advancing it's transformation sector?

>> Ajay Banga: Second one, right now very little. The World Bank is not designed to be the one that creates the innovation funds for people to develop new technologies, which still is required in carbon removal.

It's $500 a ton to take carbon out right now, not going to work. So, that's not where our development capital goes, it tends to go when a technology does exist. Can we bring it to scale like in solar and wind as I was discussing. So not enough on carbon removal yet.

The first one, I don't know yet, I will tell you that I've encountered the challenges of geopolitics every day in the last 16 months.

For example, I talked to the premier of China who was very new, I knew him from earlier, and I said I cannot get involved with geopolitics, but we have to do certain things together. We came to an agreement on climate change, healthcare for aged people, and rural development.

The Americans and the Europeans everybody is aligned with me, we can work with China on those. If I was to start thinking about funding things that impact national security, I can understand the geopolitics. We have to find the art of the possible, not deal with the art of the impossible.

And that's what I'm trying to do.

>> Arun Majumdar: If the travel is a relief for you we'll welcome you here anytime.

>> Peter Henry: Question on the left here.

>> David Fedor: David Fedor from Hoover. Thanks for your comments on electrification and using all the bullets in the gun or all the tools in the toolset.

Last week 14 major private international financial institutions talked about their support for nuclear power, that was brought up in COP 28.

>> Ajay Banga: Yes.

>> David Fedor: Is there a role for the World Bank and new nuclear going forward?

>> Ajay Banga: Yeah, so right now our board is completely aligned against not funding a single nuclear power project.

Mostly for reasons of the length of time it used to take, as well as the unpredictability of it's cost and then all the challenges around safety, but they're still thinking traditional nuclear. There's a great deal of work going on, as you know, on small modular reactors. If those get to commercial capability, I think we'll find the bank willing to get back into it.

We just had a long discussion at the board about nuclear energy. And I called the head of the IAEA to come and speak to the board so we could get this conversation going. But we have to get to the stage where those SMRs are commercially viable and provable, and then I think there's a real opportunity for the bank to get involved.

>> Peter Henry: Question here on the right.

>> Speaker 7: Thank you so much Ajay, you mentioned that there's the carbon credits industry is pretty important as we tackle climate change. How do you plan to unify that market? Because different countries have different ways of measuring carbon credit.

>> Ajay Banga: Yeah, that's why I was explaining in the case of forestry projects, where we are involved with the project.

We will compute not just the number of credits, but also the environmental and social integrity of those credits, in the sense the money does go to community and it's not cutting a tree here and planting a tree there. In the hope that the seal of good housekeeping that that provides, combined with that registry that we are doing and the training of 30 countries on how to measure these credits, we are hoping that creates the catalyst through forestry.

There is no reason why I couldn't do that for some of the methane removal work that we're doing or some other similar projects. I just want to start where I can prove that I can make a difference and then take the next step. So somewhere in the coming 12 months, you'll see us do the next step, whatever that be.

>> Peter Henry: Karen, do we have any more questions?

>> Arun Majumdar: Maybe just one more, I think many of the questions you had already addressed in you. This one is by June Choi, I know June is here. What is the World Bank's strategy for financing climate adaptation? How can you address both incremental and transformational adaptation?

>> Ajay Banga: So, of that 45% that I said I would commit to climate finance by 2025, which we'll go through we're already at 44 this year, we were at 30 the year I joined last year so, The institution has moved pretty rapidly on that one. I did say that I would try and get to half adaptation and half mitigation, and there was no science behind the half.

It is just a way to reassure the emerging markets that I was not only focused on changing their energy emission pattern, but also on caring for the hassles they're facing of dealing with something they did not cause. That was the idea unfortunately, I don't think I'll get to 50 by next year on adaptation because it takes the longest for those very countries to actually do a project of that type because they're capacity impaired.

And so adaptation projects for them are hard and so I'm working my way to build that pipeline. But the good news is they believe that I'm very serious about the 50 50. So I think that's the direction we're going in, you don't adaptation is not only about building a sea wall and better roads and better schools and hospitals it is.

But there's some very small things in Africa schools have tin sheds. They're rust colored, red painted if you paint them with white paint, that's all. It changes the temperature inside the schoolroom by eight degrees on a day. White paint, white paint is not rocket science. Preferably unleaded white paint, but white paint is not rocket science.

So this idea that everything requires some major new development is actually not true. There's a lot of work that can be done which we should be doing more of even today, and then we can keep taking a part of our brain and working on the big ones I'm trying to get people to get that as a focus.

One of the challenges of the incentives inside the institution is that cool projects which go all the way to the board for approval tend to get noticed for people who create the project but again, that's the input, not the output. The output is how many kids got a better schooling because they were able to study where it was eight degrees less in heat that's the orientation.

>> Peter Henry: Time for one last question.

>> Siddharth: Hi, I'm Siddharth I'm a PhD student in the school of sustainability. I just want to say thank you for coming to Stanford and also for your leadership on these issues. My question is kind of related to this last question. You talked about trying to catalyze private capital to fund the transition in middle income countries.

There's also a massive need for capital to adapt agriculture to a changing climate. We're past 1.5 degrees, we're gonna get past two degrees. We don't know how to grow food productively in that climate in 2022, the heat waves reduced wheat yields in India by 20%. How do you think we can catalyze more private capital to fund adaptation, particularly for smallholder farmers?

>> Ajay Banga: Yeah, so I started with the idea of renewable energy because that was the one that I was first dealing with. But I have this idea of doing this lab in three or four different areas, and one of those is exactly that. The reality of changing agriculture for small farmers starts from three or four basics.

The first one is you got to get their cooperatives working again. If you don't get their cooperatives working again, they will always remain disadvantaged in their ability to either negotiate or manage their circumstances. So I think that's kind of critical and it's mission, I think it's stable stakes, because otherwise they'll always be marginalized.

You can then do things like deliver digital and platforms and financing. But if you don't have the cooperative, you have no mechanism to get to them, either to reach them or to enable them to reach markets where they're negotiating power that they should have, which they will never have by themselves.

The idea of replacing it with mechanized farming is an idea that is not as attractive only because of all the challenges, both on climate, but also livelihoods and jobs that that creates. So we have to find a way to change that model in the right form. Then there's the issue of the kind of seeds they use and the kind of fertilizers they use so we're talking about Africa for a minute.

Soil testing station is not expensive, and it's not a big building, it's literally on a tabletop. Africa doesn't have soil testing stations that's why they use the wrong fertilizer on the wrong soil and destroy its usability. These are things that can be changed tangibly by providing it to that cooperative or to sub offices of that cooperative.

That cooperative is the link into all of this and that's kind of where I'm headed, but we'll see.

>> Siddharth: Thank you.

>> Ajay Banga: Thank you.

>> Peter Henry: Our time for conversation in hawk has come to an end, but I invite you to join us in trace help pavilion to continue the conversation,

>> Ajay Banga: Particularly these folks who are standing. Just grab me as soon as you can.

>> Peter Henry: First, refreshments for them, please. But please join me in thanking Ajay Banga, president.

>> Arun Majumdar: Let's give a big round of applause.

ABOUT THE SPEAKERS

Ajay Banga began his five-year term as World Bank Group President on June 2, 2023. Ajay Banga most recently served as Vice Chairman at General Atlantic. Previously, he was President and CEO of Mastercard, a global organization with nearly 24,000 employees. Under his leadership, MasterCard launched the Center for Inclusive Growth, which advances equitable and sustainable economic growth and financial inclusion around the world. He was Honorary Chairman of the International Chamber of Commerce, serving as Chairman from 2020-2022. He became an advisor to General Atlantic’s climate-focused fund, BeyondNetZero, at its inception in 2021. Banga served as Co-Chair of the Partnership for Central America, a coalition of private organizations that works to advance economic opportunity across underserved populations in El Salvador, Guatemala, and Honduras. He was previously on the Boards of the American Red Cross, Kraft Foods, and Dow Inc. Ajay Banga is a co-founder of The Cyber Readiness Institute and was Vice Chair of the Economic Club of New York. He was awarded the Foreign Policy Association Medal in 2012, the Padma Shri Award by the President of India in 2016, the Ellis Island Medal of Honor and the Business Council for International Understanding’s Global Leadership Award in 2019, and the Distinguished Friends of Singapore Public Service Star in 2021.

Condoleezza Rice is the Tad and Dianne Taube Director of the Hoover Institution and a Senior Fellow on Public Policy. She is the Denning Professor in Global Business and the Economy at the Stanford Graduate School of Business. In addition, she is a founding partner of Rice, Hadley, Gates & Manuel LLC, an international strategic consulting firm.

From January 2005 to January 2009, Rice served as the 66th Secretary of State of the United States, the second woman and first black woman to hold the post. Rice also served as President George W. Bush’s Assistant to the President for National Security Affairs (National Security Advisor) from January 2001 to January 2005, the first woman to hold the position.

Rice served as Stanford University’s provost from 1993 to 1999, during which time she was the institution’s chief budget and academic officer. As Professor of Political Science, she has been on the Stanford faculty since 1981 and has won two of the university’s highest teaching honors.

From February 1989 through March 1991, Rice served on President George H.W. Bush’s National Security Council staff. She served as Director, then Senior Director, of Soviet and East European Affairs, as well as Special Assistant to the President for National Security. In 1986, while an International Affairs Fellow of the Council on Foreign Relations, Rice also served as Special Assistant to the Director of the Joint Chiefs of Staff.

Arun Majumdar is the inaugural Dean of the Stanford Doerr School of Sustainability. He is the Jay Precourt Provostial Chair Professor at Stanford University, a faculty member of the Departments of Mechanical Engineering and Energy Science and Engineering, a Senior Fellow and former Director of the Precourt Institute for Energy and Senior Fellow (courtesy) of the Hoover Institution. He is also a faculty in Department of Photon Science at SLAC.

In October 2009, Dr. Majumdar was nominated by President Obama and confirmed by the Senate to become the Founding Director of the Advanced Research Projects Agency - Energy (ARPA-E), where he served until June 2012 and helped ARPA-E become a model of excellence and innovation for the government with bipartisan support from Congress and other stakeholders. Between March 2011 and June 2012, he also served as the Acting Under Secretary of Energy, enabling the portfolio of Office of Energy Efficiency and Renewable Energy, Office of Electricity Delivery and Reliability, Office of Nuclear Energy and the Office of Fossil Energy, as well as multiple cross-cutting efforts such as Sunshot, Grid Modernization Team and others that he had initiated. Furthermore, he was a Senior Advisor to the Secretary of Energy, Dr. Steven Chu, on a variety of matters related to management, personnel, budget, and policy. In 2010, he served on Secretary Chu's Science Team to help stop the leak of the Deep Water Horizon (BP) oil spill.

Peter Blair Henry is the Class of 1984 Senior Fellow at Stanford University’s Hoover Institution, senior fellow at Stanford’s Freeman Spogli Institute for International Studies, and dean emeritus of New York University’s Leonard N. Stern School of Business. The youngest person ever named to the Stern Deanship, Peter served as dean from January 2010 through December 2017 and doubled the school’s average annual fundraising. Henry is the former Konosuke Matsushita Professor of International Economics at the Stanford Graduate School of Business (2001–6), where his research was funded by a National Science Foundation CAREER Award, and he has authored numerous peer-reviewed articles in the flagship journals of economics and finance, as well as a book on global economic policy, Turnaround: Third World Lessons for First World Growth (Basic Books).