- Economics

Most of the commentary about Brexit has been nothing short of apocalyptic. A typical response came from George Soros, who claimed that the “catastrophic scenario that many feared has materialized.” He went on to speculate that other EU members would choose to punish Britain in future negotiations on separation and trade. And he seemed certain that other EU members “have reached a breaking point.”

Many other commentators also adopted a doomsday mindset. A New York Times columnist proclaimed “the stupidity of the decision.” And the economist Thomas Palley discussed a “financial bloodbath” and claimed that the Brexit vote would be seen by history as the day countries “entered the eye of the maelstrom that now promises enormous destruction.” Palley blamed the Conservative Party’s secret strategy to “smuggle in their ‘Thatcher-Reagan’ neoliberal economic agenda.” But wasn’t it the other way around—didn’t the Conservative Prime Minister fight hard to remain in the EU, while the Labor Party leader made little effort?

This dark future is not at all certain. What is certain is that Britain will pay a short-term cost for Brexit. The long-term effect cannot be known until both Britain and the EU choose their next steps and ultimate objectives. That will test the leadership’s wisdom on both sides.

What becomes clear is that, to those on the left, centralized control by the Brussels bureaucrats is much more desirable than a heroic effort by the people to strengthen their freedom. No one on the left mentions the EU’s poor prospects, its inability to develop a successful pro-growth strategy, to control the greedy special interests that especially burden France and Italy, or the waste of time, money, and attention in dealing with the failed Greek economy.

British growth has surpassed the EU average. If it chooses to increase market freedom, Britain will improve on its recent performance. Stripping away the hyperbole, the majority of voters included those who remembered that since the Glorious Revolution of 1688, the British have cherished the right of free citizens to have taxes and laws made by their elected parliament. David Cameron’s negotiations with the EU had not regained those rights. Yes, German Chancellor Angela Merkel’s decision to invite Syrian and other refugees to Germany also gave the newcomers the right to settle in Britain whether or not they were welcome. This was just another in a long list of unwelcome decisions that domestic governments could not change. It was not Britain’s only reason for leaving the EU. But it was more evidence of the people’s reduced right to choose their laws.

Although the pound has fallen in value against the dollar, and the British stock markets declined, temporarily there is no sign of the panic or catastrophe heralded by the media. Brexit is more of an orderly retreat. Market participants dislike uncertainty, but there is no way to avoid it. No one can know how soon Britain will be ready to negotiate a new agreement with the EU, how amicable the negotiations will be, and how well the British will be able to restore their trading positions around the world. Fifty percent of British trade is with the countries in the EU and another large share is with the United States. Britain has not chosen its new government, so it does not have a strategy for renewing agreements.

Further, the EU has not decided on its negotiating stance. Some call for harsh, punitive terms as a way of punishing Britain and warning other members away from following the British course. A punitive program would be a foolish mistake for two main reasons. First, it would neglect that all freely negotiated trade agreements benefit both parties. There is no way that EU countries can punish Britain by refusing to renew trade agreements without hurting themselves. Surely we can count on some cooler, calmer heads to make that clear. Chancellor Merkel appears headed that way. Of course, Frankfurt and Paris have hungered to move the huge British financial markets out of London. Britain managed to remain the financial center for the European Central Bank despite non-membership. Financial markets value the experience and trust that London has in abundance.

Rather than punishing Britain, a better way to strengthen the EU is to encourage all the other members to remain by removing the most contentious and unpopular reasons for dissatisfaction. These include immigration and the endless stream of regulations coming from Brussels over which the 27 members have no say. These are the same issues that drove British voters to favor Leave. Those sources of dissatisfaction have worked against the EU and helped the Alternative fur Deutschland in Germany, the National Front in France, Podemos in Spain, and similar groups elsewhere.

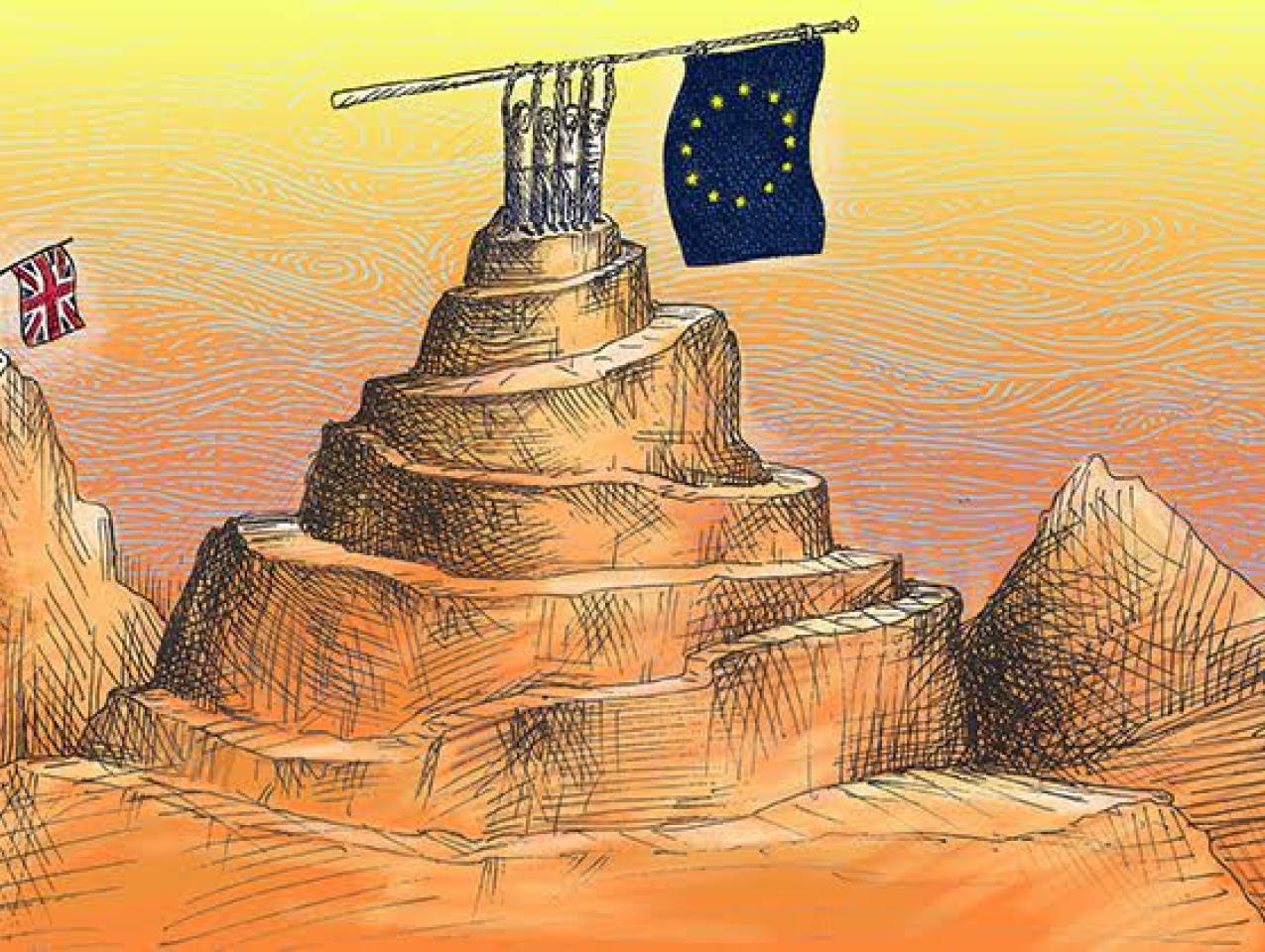

The EU’s leaders should listen to the message of Brexit and use it as an opportunity to remake the EU. The original aim of European Union was to supply some common collective policies, what economists call public goods. Chief among them was to join France and Germany in an arrangement that would prevent a future European war. But eventually, the mandate of the European Union broadened to include other public goods, like rules for trade and transport, or providing resources like water and power. Those common purposes are still best served by collective action. As member nations sought “ever closer union,” common tax rates and common regulations were imposed. That degenerated into an effort to impose a common set of rules on a very heterogeneous population. Europeans, like Americans, come from many different cultures. And also like Americans, many of them resist the rules passed down to them from a remote and centralized source of power. They oppose, in other words, some of the laws passed down to them from Brussels.

Every country has to decide what will be done best collectively and what should be accomplished locally and individually. Europe took a wrong turn when it extended its centralized control to rules that need not be common. The United States chose for centuries to leave matters of personal behavior free of collective control. It is only in recent decades that interest groups learned to impose their rules on the rest of us. Many have highlighted the similarity between British proponents of Brexit, U.S. supporters of Donald Trump, and the many who favor a stronger adherence to the rule of law. Many among the very heterogeneous populations of Europe and the United States dislike rules that violate their beliefs. In Federalist 10, James Madison cautioned against special interests that impose their principles on the rest of us.

At this stage, we can only hope that Germany will lead Europe to a new agreement for freer trade with Britain, and that it can induce its fellow members of the EU to roll back their rules and limit their efforts to providing public goods. That will not be easily done, but it is the path to a more desirable EU. For Britain, the challenge is to strengthen its trading arrangements and the rule of law. Long-term growth rises when countries recognize that future income depends on freedom for individuals and for enterprise.

After Brexit, the EU has a choice. One path punishes Britain and sustains a relatively stagnant EU. The other is harder but will lead to a stronger EU and a better world.