Statistical analysis of drilling on North Dakota’s oil-rich Fort Berthold Indian Reservation suggests that land ownership mosaics—a legacy of historical US land titling policies—reduced tribal resident earnings from the fracking boom by at least $110 million.

Based on Bryan Leonard and Dominic P. Parker, “Fragmented Ownership and Natural Resource Use: Evidence from the Bakken,” Economic Journal 131, no. 635 (April 2021): 1215–49.

LESSONS FOR POLICY

- Fragmented land rights help explain why large-scale natural resources (e.g., oil, gas, wind) on Indian reservations have been relatively underutilized.

- Federal policies that encourage the consolidation of fractionated allotted-trust land into tribal ownership will likely encourage large-scale resource use.

- For land remaining in allotted trust, land registries should be streamlined to reduce difficulties in determining ownership in fragmented landscapes.

Fragmented Ownership On Ame... by Hoover Institution

The Research Problem

Two narratives connect poverty on American Indian reservations to land and natural resources. The first focuses on historical events that pushed Indigenous people onto remote reservations with poor-quality land and few resources from which to earn income. The second focuses on what appears to be stark underutilization of land and resources that tribes did retain. Why is good farmland often left idle? Why is an estimated $1.5 trillion worth of subsurface minerals untapped? And why are wind and solar farming rare on reservations despite favorable conditions?

These important policy questions are difficult to answer in a systematic way. Some explanations, such as fragmented land ownership and trusteeship due to historical federal land titling policies, are confounded by other potential explanations, such as tribal preferences to remain undeveloped. If land fragmentation is a reason, this can be addressed by reforms to consolidate. If tribal preferences or other cultural factors are a driving force, then land reforms will have no effect.

What We Examined

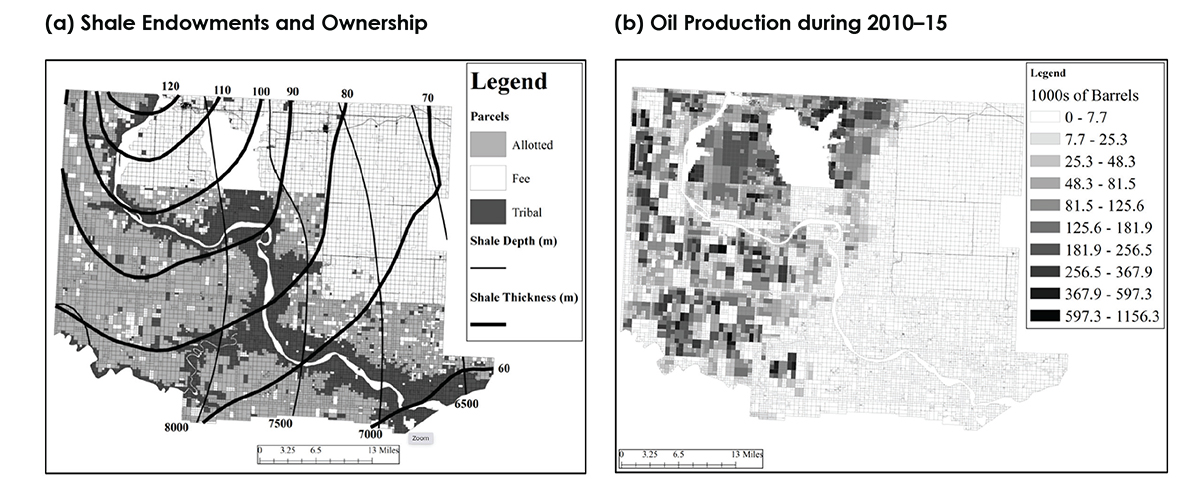

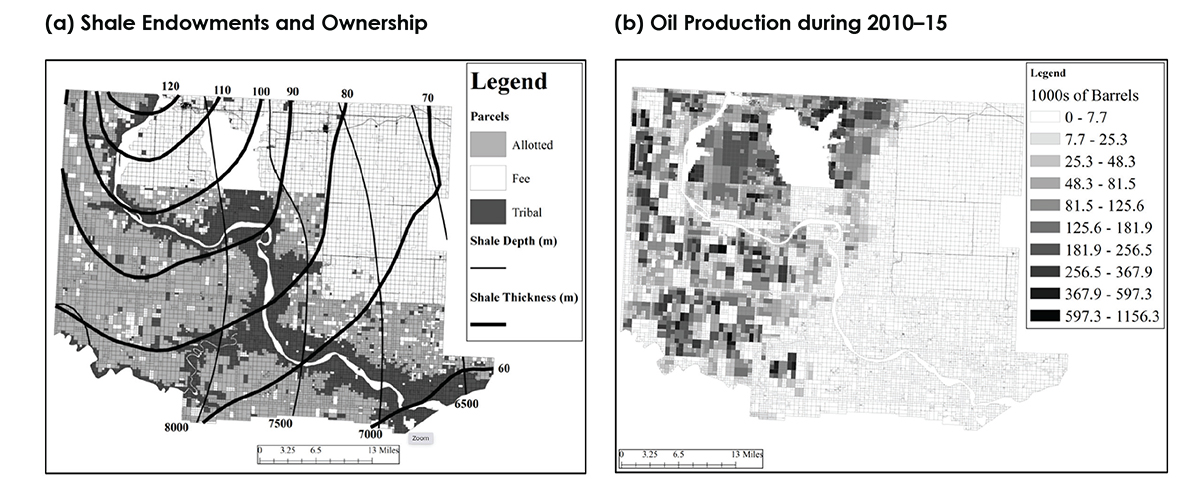

Our study utilizes a unique natural experiment to evaluate these issues. We focus on oil production from the Bakken shale formation during the fracking boom of 2010 to 2015. The Bakken—one of the world’s most valuable oil endowments—sits beneath the Fort Berthold Indian reservation, which is surrounded by North Dakota. As was the case on other reservations, federal land titling on Fort Berthold created a mosaic of parcels of varying sizes, some private with one owner (known as fee simple), some co-owned, or “fractionated,” with many owners (allotted trust), and some held by the tribal government. These policies froze ownership patterns in place and conveyed subsurface rights to landowners prior to any knowledge of the valuable shale endowment, creating variation in modern shale ownership across the reservation (figure 1).

Empirically, we compare oil production per acre for more than 8,000 parcels and estimate how a parcel’s productivity is affected by 1) its own size and ownership type (fee simple versus allotted trust versus government); and 2) the fragmentation of surrounding land (i.e., within a half-mile radius) that could be included in the same oil extraction project. The comparisons account for shale thickness and depth, which affect profitability, allowing us to isolate effects of ownership fragmentation at the scale of a drilling project. Importantly, drilling projects require permission from subsurface owners, implying that the profitability of shale development from any given parcel depends on the costs of accessing shale from adjoining landowners. These costs grow with the number of owners whose consent is required at the spatial scale of a drilling project. When the number of contracting parties is sufficiently large, drilling is not profitable.

Fig. 1: Oil Endowments, Land Ownership, and Oil Production. Panel a shows ownership along with geological estimates of shale depth and thickness beneath the Fort Berthold Indian Reservation. Thicker shale holds more oil, and deeper shale is more costly to access. Panel b shows estimated production during 2010–15. The eastern part of the reservation was not profitable to drill due to the lack of sufficiently thick shale.

What We Found

Both the type and size of parcels affected oil production. A fee-simple parcel large enough to fully encompass a drilling project yielded 141 more barrels than an equivalently sized parcel in an allotted trust, which had on average 17 owners. Private and allotted-trust parcels in our sample, however, are rarely large enough to fully encompass a drilling project, because historical policies subdivided land into relatively small parcels. Expected production decreased with the subdivision of neighboring parcels: by one barrel per fee-simple parcel and six barrels per allotted-trust parcel in the surrounding area.

Drilling was much more productive in areas where the tribal government owns large tracts of contiguous land when compared to areas dominated by allotted-trust land. This is consistent with oil companies favoring deals with the tribal government when the number of individual owners became large. In the words of one local media reporter, the fragmented land base made it “almost impossible for companies to gather the approval of all the landowners.”

In a policy thought experiment motivated by recent federal efforts at land reform on Indian reservations, we estimate the effects of a pre-boom consolidation of all allotted-trust subsurface ownership into tribal ownership. By reducing fragmentation, the consolidation would have increased initial royalty earnings during the boom by over $110 million in today’s dollars. This amounts to roughly $22,000 for each fractional-interest owner or $9,000 for each tribal member. These findings point to land-use challenges, rather than culture, as the dominant explanation for underutilization. After all, decisions to allow drilling on allotted-trust versus tribal government lands were governed by the same population of tribal members.

Author Affiliations

Bryan Leonard is an economist at Arizona State University and a 2019–20 Campbell Visiting Fellow at the Hoover Institution at Stanford University. Dominic Parker is an economist at the University of Wisconsin and the Ilene and Morton Harris Visiting Fellow at the Hoover Institution.