- Contemporary

- International Affairs

- US Foreign Policy

- History

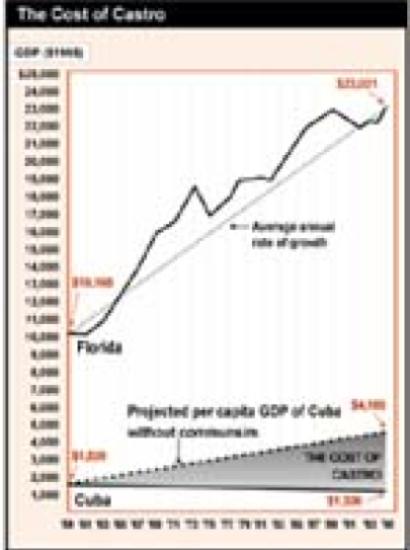

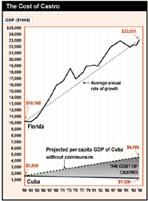

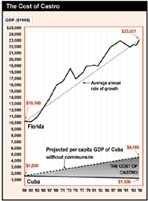

What is the cost of Castro? Communist economies are notoriously tricky to estimate, but it appears that Cuba’s inflation-adjusted per capita income has actually fallen since Fidel Castro’s revolution in 1959. In dramatic contrast, Florida, just ninety miles to the north, has boomed—as have other Sunbelt states such as Texas and Arizona. Their revolution was air-conditioning. And it worked.

In the language of the takeover artists, Cuba is an underperforming asset.

To estimate the cost of Castro, we assume that Cuba’s current per capita output should be about the same proportion of Florida’s output as it was in 1959. This gives us a current figure ($4,169)—more than three times higher than Cuba’s actual output ($1,300)—modestly placed between that of Jamaica ($3,200) and Mexico ($7,700).

In fact, Cuba would probably have done considerably better than this. A 1956 U.S. Department of Commerce guide for businesses flatly said that “Cuba is not an underdeveloped country in the sense usually associated with that term,” citing its infrastructure, industrial development, and large middle class. Its living standards were reported to be among the highest in Latin America—then.

A hint of what might have been: Even troubled Mexico’s per capita GDP has closed in on that of the United States over the last four decades—from less than an eighth in 1959 to about a third recently. Still, our modest estimate suggests that the shortfall in Cuban GDP as a result of Castro was a hefty $31.5 billion in 1995.

In the language of takeover artists, Cuba is an underperforming asset. Not all of this value could be realized immediately, of course—but enough to suggest it would be well worthwhile to offer Fidel a very golden handshake (say $5 billion) to retire to Spain.

Or maybe one of his middle managers may try an LRO—leveraged rubout?