- Budget & Spending

- Economics

- Monetary Policy

The architecture of derivatives’ markets is now in play because of two related policy concerns that arose from the financial crisis: systemic risk and market efficiency.

Systemic risk is the danger that failing financial institutions will destabilize the financial system and thereby threaten the wider economy. When unconstrained by effective risk management or regulation, derivatives enable high concentrations of risk in individual financial institutions. Derivatives’ markets are efficient if trading costs are low and risk is well distributed among investors. The most important ingredient for market efficiency is competition, which in turn depends on price transparency and on relatively unencumbered access to trading by a broad set of market participants.

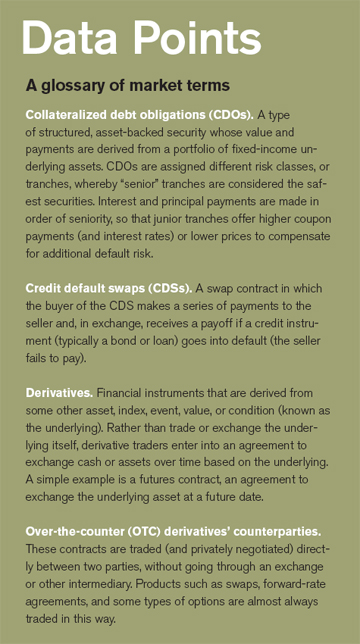

The financial crisis was exacerbated by derivatives’ markets in two basic ways. First, insurance companies such as AIG, Ambac, and MBIA used credit default swaps (CDSs) to sell protection on collateralized debt obligations (CDOs) backed by subprime mortgages to such an extent that those companies were severely impaired when the CDOs experienced large losses from mortgage defaults. This in turn contributed to the weaknesses of the banks that had bought these CDSs, relying on that protection.

The second exacerbating factor was the failure of the large investment banks. The problems faced by Bear Stearns and Lehman Brothers were increased by a run on their over-the-counter (OTC) derivatives’ counterparties. The flight of those derivatives’ counterparties, as they sought new positions with other dealers, may also have contributed to the fragility of global financial markets. In the same vein, a number of other large dealer banks had to be bailed out for reasons that included the dangers posed by the potential flights of their derivatives’ portfolios.

AIG, the most egregious example of the CDS/CDO type, was bailed out in response to losses suffered by its subsidiary AIG FP, which had sold CDS protection on more than $400 billion of CDOs. As AIG’s losses mounted, downgrades to its credit rating were about to trigger contractual obligations, meaning that AIG would have to post large amounts of additional collateral on its CDS positions. When AIG did not have the resources to meet those calls for more collateral, the federal government stepped in, at a massive cost to U.S. taxpayers.

Clearing (providing a guarantee from a central clearing counterparty) would not have helped AIG, for its credit derivatives’ contracts were customized to its particular CDOs. Even had CDS clearing existed at the time, the AIG credit default swaps would not have been sufficiently standard to have been cleared. Only better risk management by AIG and better regulatory supervision could have prevented the disaster.

As an example of the second type of danger posed by derivatives, Bear Stearns’ OTC derivatives’ counterparties reduced their exposures to Bear Stearns as news of its weakness spread. As they moved their derivatives’ positions to other dealers, they withdrew the cash collateral they had posted with Bear Stearns, reducing Bear Stearns’ liquidity and accelerating its failure.

Further, the derivatives’ positions held by the counterparties of Bear Stearns and Lehman had served a particular business purpose, such as hedging business risks. With the failures of those dealers, the counterparties needed to replace their derivatives’ positions quickly. A surge of demands for new derivatives’ positions with other dealers caused severe pressures on a range of financial markets, sometimes distorting normal price relationships and adding to the general disruption.

All the proposed legislation for derivatives’ reform can be evaluated using several policy options that are believed, in varying degrees, to reduce systemic risk and improve the efficiency of the derivatives’ markets. They are

- Centralized clearing. Clearing insulates counterparties from one another, provided that the clearinghouses are themselves well designed and capitalized. In addition to any direct reductions in counterparty risk, clearing reduces the sort of run-on-the-bank behavior that likely quickened the failures of Bear Stearns and Lehman.

- Improved price transparency. Markets tend to be more efficient when the “going price” is well known by market participants. OTC derivatives’ markets have limited price transparency. Some analysis should be devoted to the question of which markets deserve additional levels of price transparency, for none of the main legislative proposals require such transparency.

- Improved position transparency. Another issue is the availability of data on the sizes of derivatives’ positions, which would allow the monitoring of risk concentrations with systemic implications. Concerns exist, however, about what amount and type of data are appropriate to be disclosed and to whom. Proposed legislation calls for all OTC derivative trades to be reported to qualified trade registries. Those data will be available to regulators, with some summary information possibly provided to the public.

- Migration of over-the-counter trading to exchanges. More extensive use of electronic trading platforms and of the kind of price transparency found in TRACE (Trade Reporting and Compliance Engine) would reduce the inefficiencies associated with OTC market opaqueness. Legislation appears likely to require that all “standardized” derivatives be traded on exchanges or on “alternative swap execution facilities,” subject to exceptions allowed by the enforcing agencies: the Securities and Exchange Commission and the Commodity Futures Trading Commission. Forcing derivatives’ trading onto exchanges by regulation should, however, be done with caution.

- Speculative position limits. It has been proposed that speculative derivatives’ trading should be severely curbed or even—in the case of CDS markets—outlawed. Such proposals, however, are based, at least in part, on a misconception of the role of speculation. Outlawing the speculative use of credit default swaps to buy protection would have the unintended consequences of reducing market liquidity (because those selling protection would have less incentive to incur the costs of remaining informed and active traders) and of driving this form of speculation “under the radar,” through the use of less-effective and transparent types of financial products.

- Allowance for customization and innovation. Derivatives that are not easily cleared or exchange traded are typically those customized to suit the specific business uses of investors, for which there should be some tolerance for innovation and customization. Economic efficiency is harmed if those with commercial needs for hedging are forced into standard derivatives’ positions that are relatively poor hedges or if derivatives’ markets are unable to innovate along with changes in the economy.

In summary, the increased use of central clearing represents the most powerful way to reduce the systemic risk arising from OTC derivatives’ markets. Some key steps that regulators should take are (1) pressuring dealers to adopt specific numerical targets for lowering exposures (before collateral) on uncleared derivatives positions, (2) increasing regulatory capital requirements for uncleared-versus-cleared derivatives, (3) persuading dealers to clear a greater fraction of dealer-to-customer positions, and (4) fostering international coordination in the regulation, supervision, and failure resolution of clearinghouses. It would be counterproductive, in my opinion, for regulators to reach for legal definitions of the types of derivatives that are to be cleared.