- Regulation & Property Rights

- Law & Policy

In the United States, water wars between states and between users are in full swing.

In 2001, the federal government cut water supplies to 1,400 farms in Oregon’s Klamath River basin to protect endangered suckerfish and Coho salmon. Thousands of people affected by the decision rallied to support farmers by creating a bucket brigade to carry water to their dry irrigation canal. Similarly, in 2009, the Bureau of Reclamation cut off water to farmers in California’s San Joaquin Valley, drying up as many as 75,000 acres at a cost of approximately $350 million in lost agricultural production. A drought in 2008-09 in the southeastern United States pitted Atlanta with its burgeoning population against Florida and Alabama for control of water supplies. Such conflicts have led businessman T. Boone Pickens to predict that water is "the new oil."

Illustration by Barbara Kelley

Mark Twain supposedly quipped that "Whiskey is for drinkin’ and water is for fightin.’" Why this dichotomy? The simple answer is that whiskey is produced in the marketplace where suppliers and demanders gain from trade, while water is mainly subject to the "tragedy of the commons," or to political allocation. With markets, whiskey prices will reflect shortage or abundance. Without water markets, demanders race to pump from the common pool or face prices set by politicians and bureaucrats which have little relationship to actual scarcity.

Water price differentials among uses illustrate the potential for, yet lack of, water markets. Table 1 below shows average and median prices per acre-foot (the amount of water it takes to cover one acre a foot deep, or approximately 325,000 gallons) for a 22-year period for 12 western states. Clearly, agriculture-to-urban prices for water transfers are higher than for agriculture-to-agriculture trades. Some of the difference may be associated with the higher costs of moving water to cities, but the large difference suggests that there are potential gains from trade not being realized via market trades.

The potential for trade is also evident at the local level and across state boundaries. For example, between 2002 and 2008, there were 1,025 water sales to urban users in Reno-Sparks, Nevada, with a median price of $17,685 per acre-foot, as compared to only 13 sales to agricultural users with a median price of $1,500. Prices also differ sharply by state, with averages for one-year leases ranging from $8 per acre-foot in Idaho to $87 in Arizona, and averages for sales ranging from $113 per acre-foot in Idaho to $6,592 in Colorado.

Table 1: Water Transfer Prices by Sector 1987-2008 (2008 dollars per acre-foot)

| Price Type | Agriculture-to-Urban Leases | Agriculture-to-Agriculture Leases | Agriculture-to-Urban Sales | Agriculture-to-Agriculture Sales |

|---|---|---|---|---|

| Median Price | $74 | $19 | $295 | $144 |

| Mean Price | $190 | $56 | $437 | $246 |

| Number of Observations | 204 | 207 | 1140 | 215 |

Such price disparities beg the question, why aren’t there more water trades? For any market—land, automobiles or water—property rights must be well defined, enforced, and transferable, but this is far from the case for groundwater and only somewhat better for surface water supplies.

Typically groundwater is available to anyone who sinks a well and pumps. The result is a "race to the pumphouse" in which aquifers are depleted. For example, watertables have fallen by over 50 meters in the Ogallala Aquifer in the Western United States, by 10 meters in the Punjab region of India, and by 40 meters in the northern Hebei province of China according to the Oct. 7, 2010 issue of the Economist. With nearly 300 major aquifers shared by two or more nations, this problem is only likely to become worse.

In jurisdictions where aquifers have been over-pumped for years (e.g. Arizona), groundwater pumping rights are evolving slowly, but for the most part, states have dealt with over-pumping by regulating new wells, allowing only a modest role for water markets. For example, in Montana, new wells pumping more than 35 gallons per minute and up to 10 acre feet per year are only allowed if the person seeking a permit purchases surface water irrigation rights and retires them or purchases existing wells and ceases pumping from them. This has an element of a market, but is also highly regulatory.

Where water markets are being allowed to work, prices reflect scarcity and trades provide incentives to conserve.

Surface water rights and therefore surface water markets have evolved a little further. In the American West, for example, miners and irrigators, who found themselves competing for water on the frontier, hammered out the prior appropriation doctrine. This legal system grants diversion rights on a "first in time–first in right" basis. Under prior appropriation, when there is insufficient water to meet all demands, those who established claims at the earliest times have priority over those who began diverting later. In most western water basins this means that agricultural users have senior rights over municipal and environmental demanders.

Because prior appropriation rights often preceded the establishment of formal state governments, the rights are not always clearly specified and recorded. To clarify water rights, some states (e.g. Montana) have established a special water court to elucidate priority dates and quantify diversion rights.

Other parts of the United States lag behind the West when it comes to having water rights systems that allow and encourage trading. Water use in the eastern United States is predominately governed by the riparian doctrine, which gives riparian landowners co-equal rights to an undiminished quantity and quality of water. This system was carried over from English common law and worked well when the main water demands were for small amounts of domestic consumption and for in-stream power production (e.g. mill ponds and subsequently hydro-electric power generation). Especially with increased urban population demands, the riparian doctrine is proving inadequate for resolving conflicting demands.

In response, states and municipalities try to limit water use by specifying the days when lawns can be watered, hiring "water police," and prohibiting restaurants from serving tap water. Such regulations do little to curtail demand and do nothing to encourage the water use efficiency available from water markets.

Not All See Gains from Trade

Even with rights clearly defined, procedures for trading are purposefully complex so as to protect third parties from injury. This is best understood in the case of irrigation. When irrigation water is diverted from a stream, not all of the water is consumed by the crop; some finds its way back into the stream to be claimed and used downstream. If a senior right irrigator sells his water to another user, say a water bottling company, the return flow could be reduced and a downstream claimant harmed. Regulatory processes in most states prevent harm to other water rights owners by requiring proof that third-parties are not adversely affected by the trade.

Unfortunately, state and local laws and court decisions have expanded scope for claiming harm by water trades and thus raised the cost of market transactions. They have done this in two ways. First, laws and regulations sometimes allow people only tangentially related to water use to protest transfers. California has an especially tortuous system, with the state’s Water Resources Control Board and Department of Water Resources, as well as the Federal Bureau of Reclamation, getting in on the act. The control board alone has legal authority to veto transfers that would "unreasonably affect the overall economy of the area from which the water is being transferred."

Mark Twain quipped that "Whiskey is for drinkin’ and water is for fightin,’" and T. Boone Pickens predicts that water is "the new oil."

Further, 22 of California's 58 counties have asserted rights to restrict the extraction and export of groundwater. These county ordinances also can limit surface water transactions if they appear to diminish groundwater resources. It seems that a major objective of the ordinances is to prevent reallocation to urban or environmental uses.

Second, courts have opened the floodgates for protesting water transfers through the "public trust doctrine." This common law doctrine, inherited by the United States from Great Britain, was originally utilized to protect the public's interest in commerce, fishing and navigation on navigable waterways. Expanded use of this doctrine brings into question long-held water rights. The quintessential case is National Audubon Society v Superior Court of Alpine County in 1983. In that case the court found that the state had a trust responsibility to protect the environment.

It’s Hard to Keep a Good Market Down

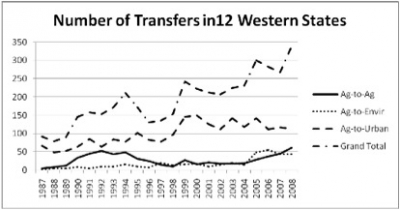

Though ill-defined water rights and legal doctrines such as the public trust doctrine inhibit water markets, the potential for gains from trade are stimulating market transactions. Water brokerage firms are springing up to facilitate trades, and environmental groups are increasing instream flows by acquiring and then retiring agricultural diversion rights. Figure 1 shows that agriculture-to-urban and agriculture-to-environmental transfers are increasing.

Figure 1

Photo Credit: http://www.bren.ucsb.edu/news/water_transfers.htm

Priming the Pump

As long as water allocation remains in the domain of legislatures and courts and out of the marketplace, shortages and conflict will persist. Where water markets are being allowed to work, prices reflect scarcity and trades provide incentives to conserve.

A case study undertaken by The Nature Conservancy illustrates what can happen. Colorado cities and towns on the eastern slope of the Rocky Mountains have experienced some of the most rapid population growth in the United States. In this arid region, most of their water demands have been met either by claiming more water from streams, if there is unclaimed water, or by transferring water from agricultural to municipal uses.

If growing demands on a limited supply were not enough, a 1922 interstate agreement, known as the Colorado River Compact, requires that Upper Basin states (Colorado, New Mexico, Utah and Wyoming) deliver water at a rate of 7.5 million acre-feet per year on a ten-year rolling average to Lower Basin states (Arizona, California, and Nevada). If the downstream flows are not adequate, junior water rights established after 1922 and held mostly by municipalities must be cut to meet the agreement. Senior water rights perfected before the 1922 agreement and held most by farmers and ranchers on the west slope of the Rocky Mountains, on the other hand, would not be affected except in the most severe droughts.

A market solution is to create a water bank that would allow front range municipalities with junior water rights to contract with east slope irrigators with senior rights. In years of abundance when there is plenty of water for all, no trades would be necessary, but in low-flow years the bank would connect depositors—senior water right owners offering to sell water—with borrowers—junior water right owners offering to buy water. In other words, municipalities could pay senior water right holders who generally put water to low valued uses (e.g. irrigated hay) to forego diversions so water could continue flowing to higher valued municipal uses.

This example illustrates three ingredients necessary to prime the water market pump.

- Clarity—water rights must be adjudicated and recorded so that traders can be identified.

- Transparency—trades must be transparent so that all players understand the potential gains for all users.

- Expediency—legislatures and courts must stay out of the way of willing buyer-willing seller trades that don’t violate other water rights holders.

Following these simple guidelines will not only increase the flow of water to higher valued uses including the environment, it will drain less from public treasury and put less stress on the social fabric.