In early January, California Gov. Jerry Brown unveiled his proposed budget for the 2014-15 fiscal year. Earlier today, Gov. Brown took the second step in the process by releasing his May Revise of the spending plan.

The Revise comes after State Controller John Chiang announced last week that revenues from the major statewide revenue sources –personal income, corporate income and sales taxes – were about 2.2% above January’s calculations and year-to-date revenues were 2.8% above projections. Since projections already incorporate new Proposition 30 tax revenue estimates, these strong revenue numbers are on top of the tax increases passed in 2012 by the voters. Despite the above-projection revenues, leading Democrats, such as Mark Leno of San Francisco and Noreen Evans of the Northern Coast, are pushing for permanent tax increases or additional taxation.

The Revise also includes important information about the re-negotiated rainy-day fund that Sacramento leaders announced last week, which would transfer 1.5% of total general fund revenue each year in addition to capital gains revenue that exceeds 8% of general fund taxes. Approximately $1.6 billion would be transferred into the rainy-day fund in the coming fiscal year, pursuant to Proposition 58, with savings rising to $2.2 billion in FY 2017-2018.

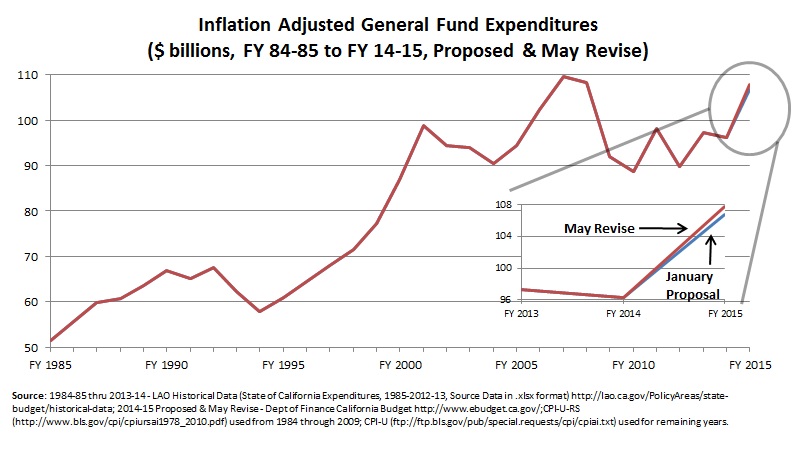

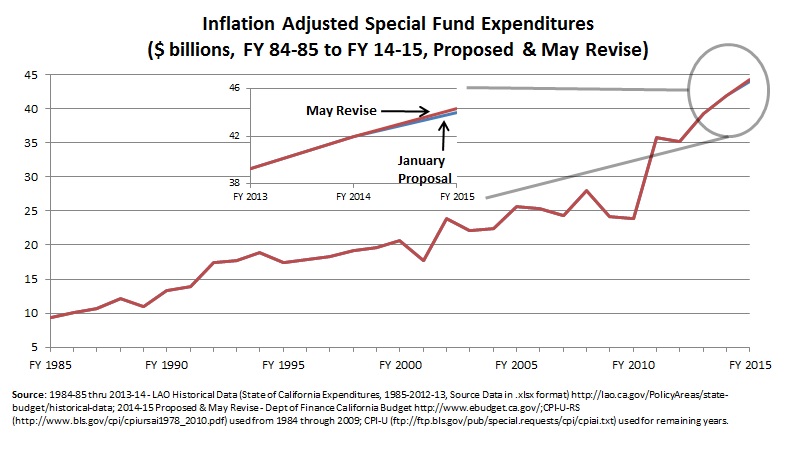

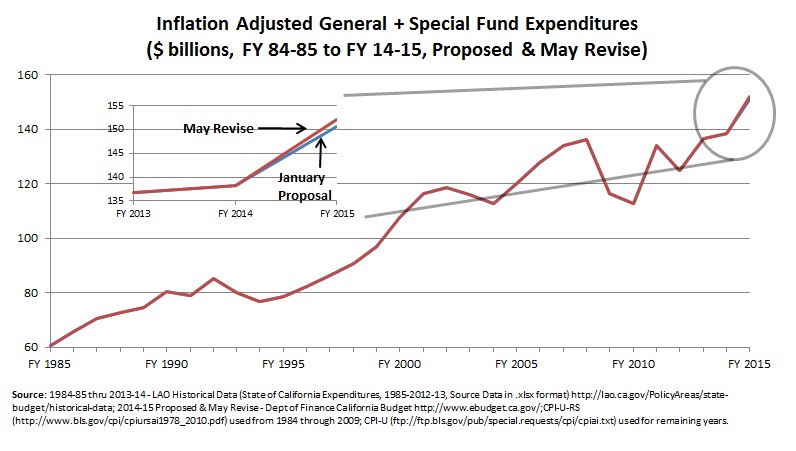

As explored in January, however, the Governor’s proposed budget was anything but frugal. For one, it increases General Fund expenditures (adjusted for inflation) by 11% from the previous fiscal year, representing a 108% increase over the past thirty years. Special Fund expenditures, likewise adjusted for inflation, would increase almost 5% from the past year, representing a whopping 373% increase over the same 30-year timeframe. Overall, total General and Special Fund expenditures would increase 9% since the previous fiscal year – and 148% since the mid-1980’s.

However, the Brown budget has been buoyed by strong revenue collections this year. And so the Governor has revised his spending plan upward to replenish even more of the cuts made during the recession. As the charts below show, the increases are slight (about 1% from the January proposed budget), but still significant.

The May Revise would put General Fund expenditures at $108 billion, the highest level since FY 2006-2007, inflation adjusted. This would represent a 12% increase from FY 2013-2014 and almost a 110% since FY 194-1985. General Fund expenditures would represent an increase of 20% since Brown’s first budget (FY 2011-2012).

Much of Sacramento’s spending over the years has shifted from the General Fund to the Special Fund. The rapid increase has largely occurred in just the last decade or so. Between FY 1984-1985 and FY 2000-2001, Special Fund expenditures doubled. But since then (through the May Revise), Special Fund expenditures ballooned by 151%, its highest level ever representing a 377% increase since the mid-1980’s. Since Brown’s first budget, special fund expenditures have increased by 26%.

Because of this growth in special fund expenditures, it’s necessary to examine both General and Special Fund spending in order to holistically understand the budget. January’s version of the proposed budget had both funds’ expenditures peaking at $150.8 billion. The May Revise bumps this up an additional $1.3 billion to $152.1 billion – a 10% increase since the last fiscal year and a 151% since FY 1984-1985. Since Brown’s first budget, total General and Special Fund expenditures have jumped 22%.

Brown and legislative leaders are pinning their hopes that future economic downturns won’t affect the budget because of the new rainy-day fund, which voters still need to approve in November. This hopeful thinking allows Brown to propose record spending despite the fact that California’s volatile budget and revenue sources ensure California will face serious budget uncertainty again in the future. While a strong rainy-day fund is one step to fiscal responsibility in Sacramento – and the jury is still out whether the rainy-day proposal would actually save enough for future downturns – other necessary steps include expenditure control, long-term debt repayment (valued by the state’s Legislative Analyst’s Office at $341 billion, which is probably an under-estimate) and, finally, tax reform.

Until all steps are taken, Sacramento’s myopic budget approach will continue to lead to massive budget swings.

Follow Carson Bruno on Twitter: @CarsonJFBruno

Read more about the January Proposed Budget here.