- International Affairs

- US Foreign Policy

Free money is the scourge of Israel’s economy. It is the difference between a free, prosperous Israel and a statist, dependent Israel.

What do I mean by the term free money? Free money consists of unilateral transfers in the national income accounts. Free money is first and foremost U.S. aid to Israel. It began at relatively low levels, less than $1 billion, in the early 1970s. It reached its present proportions during 1984–1985. It has exceeded $3 billion every year since 1985. In addition to official U.S. aid, free money includes German reparations, individual remittances, and institutional remittances. Free money also includes U.S. government loan guarantees in that the proceeds of these guarantees, some $2 billion a year, are available for immediate spending, whereas the immediate costs of interest and debt repayment are less than $100 million.

During the past decade, free money has supplied between 10 and 15 percent of Israel’s gross domestic product and has amounted to the equivalent of some 20 percent of government spending. This sum is sufficient to bail out or prop up every money-losing socialist institution in the country, provide hefty pay raises for government employees, and even leave some money left over for investment.

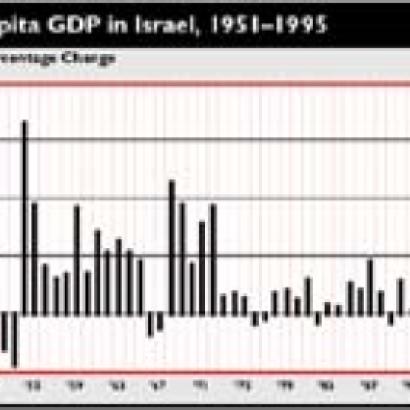

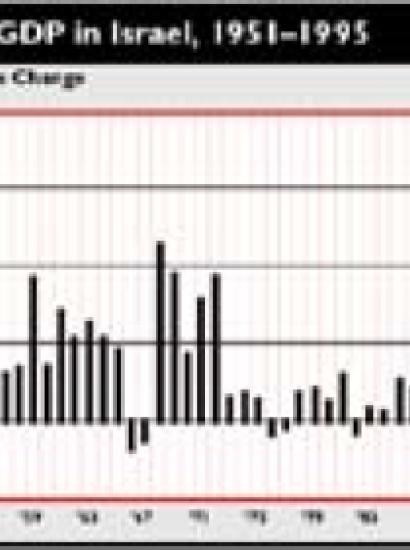

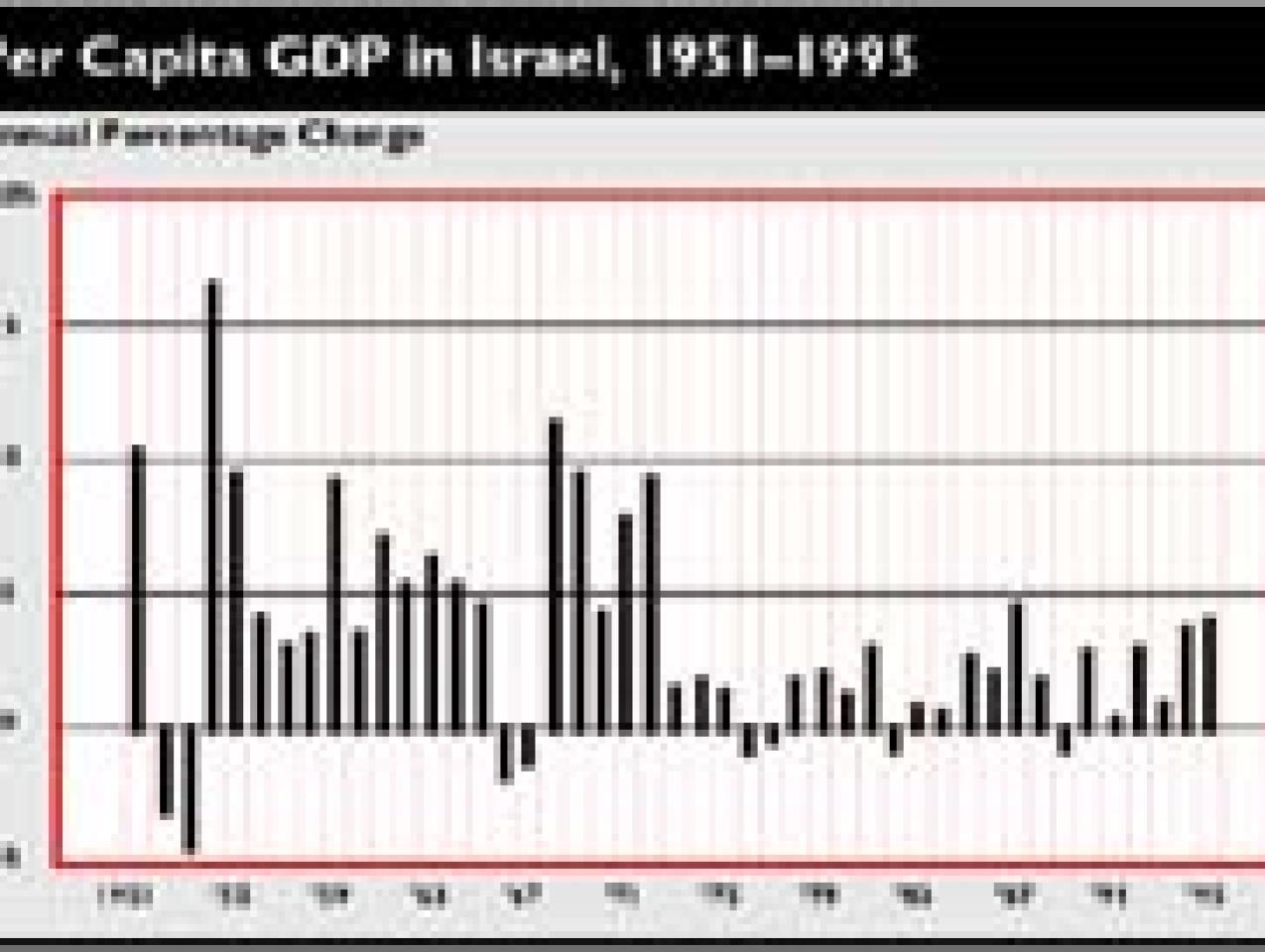

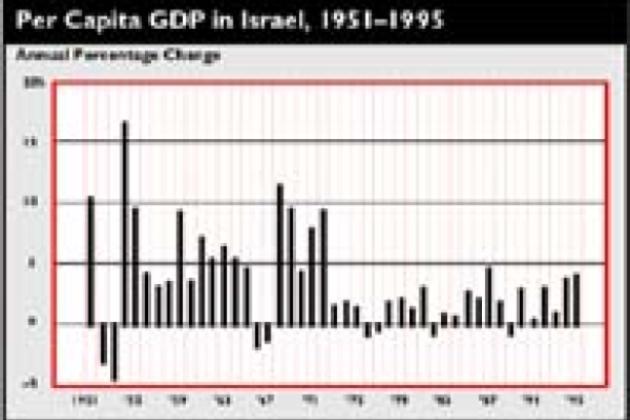

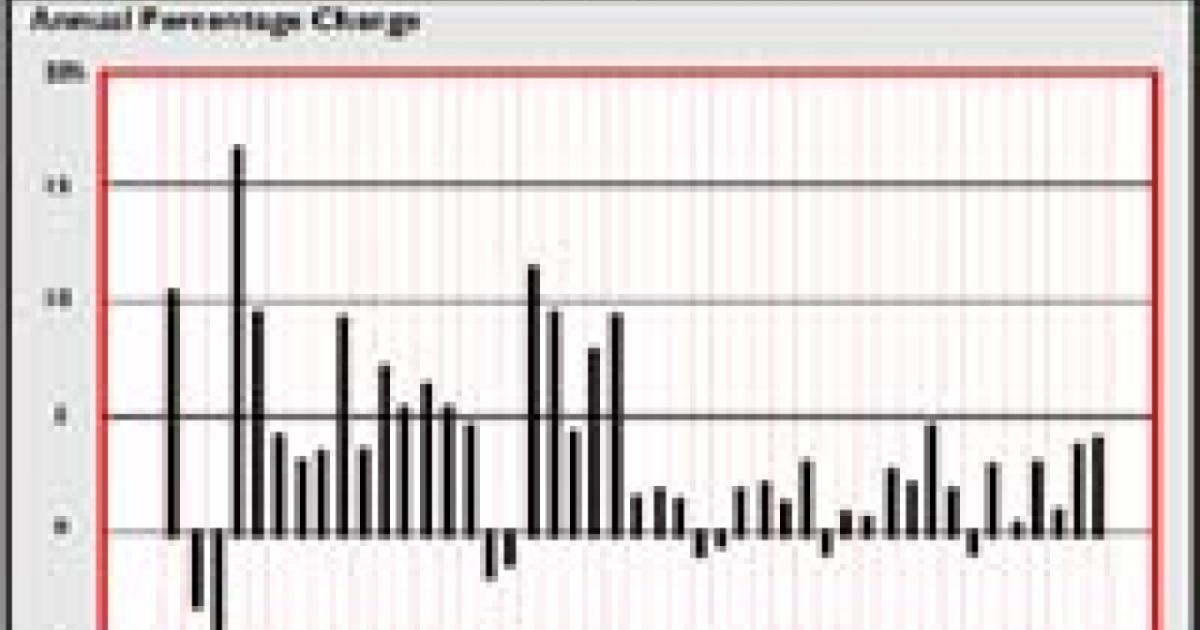

The single best indicator of economic development and growth is the annual increase in per capita income. The graph above displays the annual percentage change in per capita GDP in Israel during 1951–1995. Remember, U.S. aid began flowing into Israel after 1973. During 1951–1972, with the exception of a downturn during 1952–1953 and during the period of the Six-Day War and its aftermath in 1966–1967, Israel’s economic performance rivaled that of the high-growth Asian Tigers, averaging about 5 percent per capita per year. At this rate, per capita income doubles in about fourteen years. Between 1973 and 1995, the annual percentage increase in per capita GDP, 1–2 percent, was much less than half that for the earlier period.

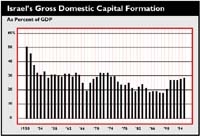

A good measure of an economy’s productive potential is the share of national income invested in capital formation. The graph above shows that gross domestic capital formation averaged about 30 percent of GDP between 1949 and 1974. As aid rose and stabilized as an important resource to Israel, the country went on a consumption binge, saving and investing less.

There are lots of reasons to support aid to Israel. One is to show support for Israel, surrounded as it is by undemo-cratic Arab states that have not yet showed a willingness to live in peace with Israel. Another is to show the Arab states that the United States firmly stands by its democratic ally in the volatile Middle East. A third is that aid to Israel is really a form of saving money on overseas defense by ensuring the support of a loyal, reliable ally in the Middle East, which is much cheaper than the level of funds expended on U.S. participation in NATO.

Before U.S. aid began flowing, Israel’s economic performance rivaled that of the high-growth Asian Tigers. Since then, Israel’s growth rate has fallen by more than half.

But the price of these convictions is twofold. First, it has cost the economy and people of Israel dearly. Had Israel sustained its high-growth pattern of its first few decades, per capita income would be $10,000 or more per person and annual economic output would be larger by another $50 billion, giving Israelis an American or northern European standard of living. The annual GDP of $50 billion is five times larger than the annual inflow of free money. Second, U.S. aid, flowing directly into the hands of the Israeli government, has denied the Israeli people freedom from the clutches of its statist government.