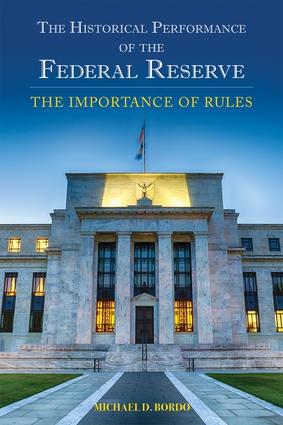

Economist Michael D. Bordo argues in a new Hoover Institution Press book for the importance of monetary stability and monetary rules, offering theoretical, empirical, and historical perspectives to support his case.

In The Historical Performance of the Federal Reserve, Bordo, a Hoover distinguished visiting fellow, shows how the pursuit of stable monetary policy guided by central banks following rule-like behavior produces low and stable inflation, stable real performance, and encourages financial stability. In contrast, he explains how the failure to adhere to rules will inevitably produce the dire consequences of real, nominal, and financial instability.

Specific topics include:

- The relationship between the timing of changes in several instruments of monetary policy and the timing of changes in real output and inflation across US business cycles

- The reasons why recessions associated with financial crises are generally followed by fast recoveries: policy uncertainty and the weak nature of residential investment

- The relationship between policy-induced monetary changes and credit crises.

- The lessons learned from the US banking panics in the early 1930s applied to the response by the Federal Reserve to the crisis of 2008

- Evidence that aggregate price shocks (often induced by monetary policy) cause or worsen financial instability—and that a monetary policy focused on price stability would be conducive to financial stability

- How the US economy would have fared if it had a central bank in the eighty years before the establishment of the Federal Reserve in 1913

- How the Great Contraction of 1929-1933 would have been mitigated and shortened had the Federal Reserve followed a constant money growth rule.

Media Contacts

Clifton B. Parker, Hoover Institution: 650-498-5204, cbparker@stanford.edu