- History

This essay is based on the working paper “Paper Money in the Late Qing and Early Republic, 1820–1935” by Matthew Lowenstein

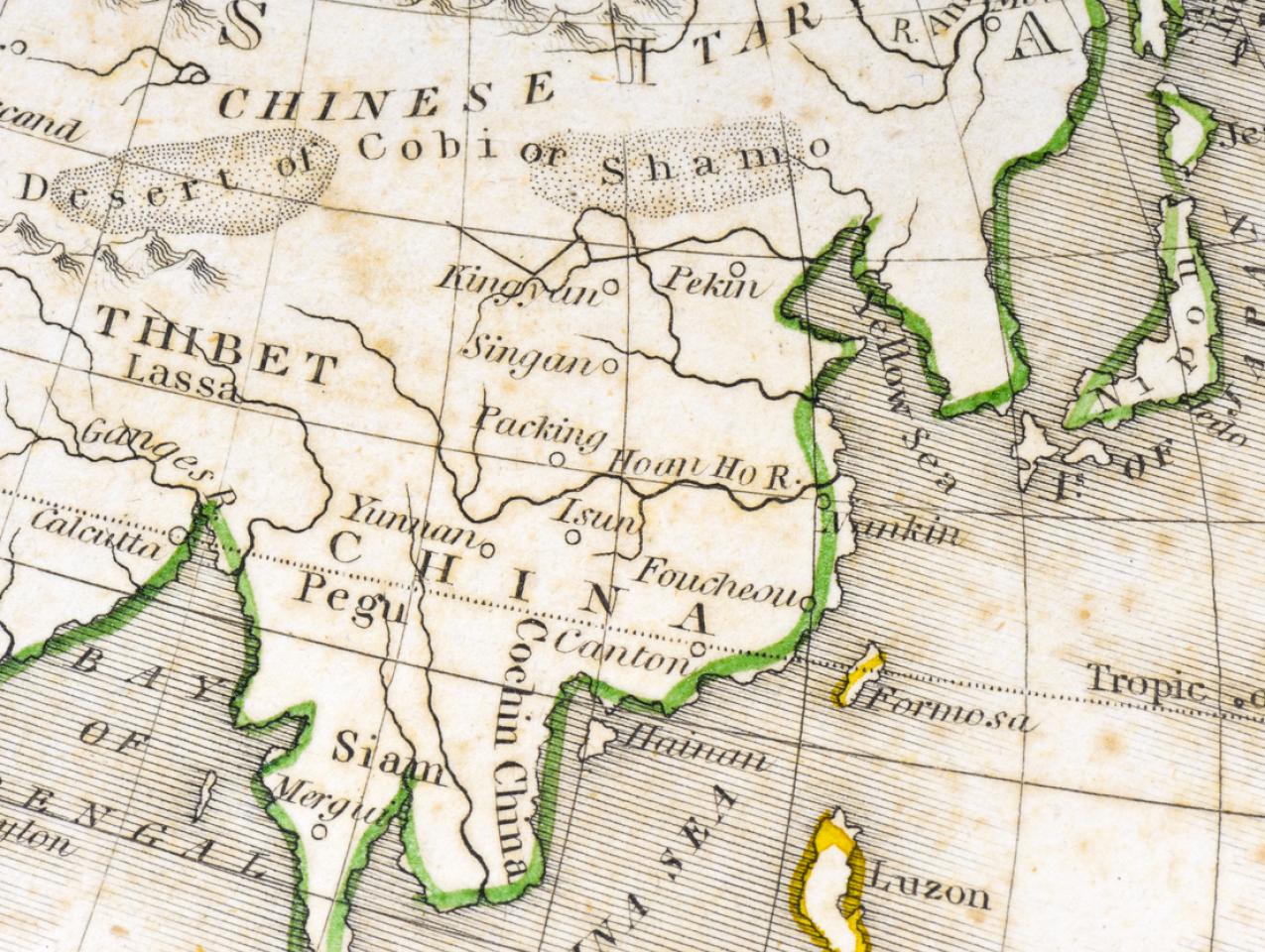

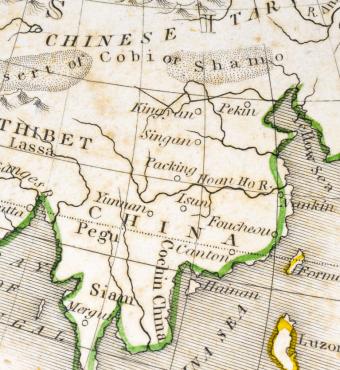

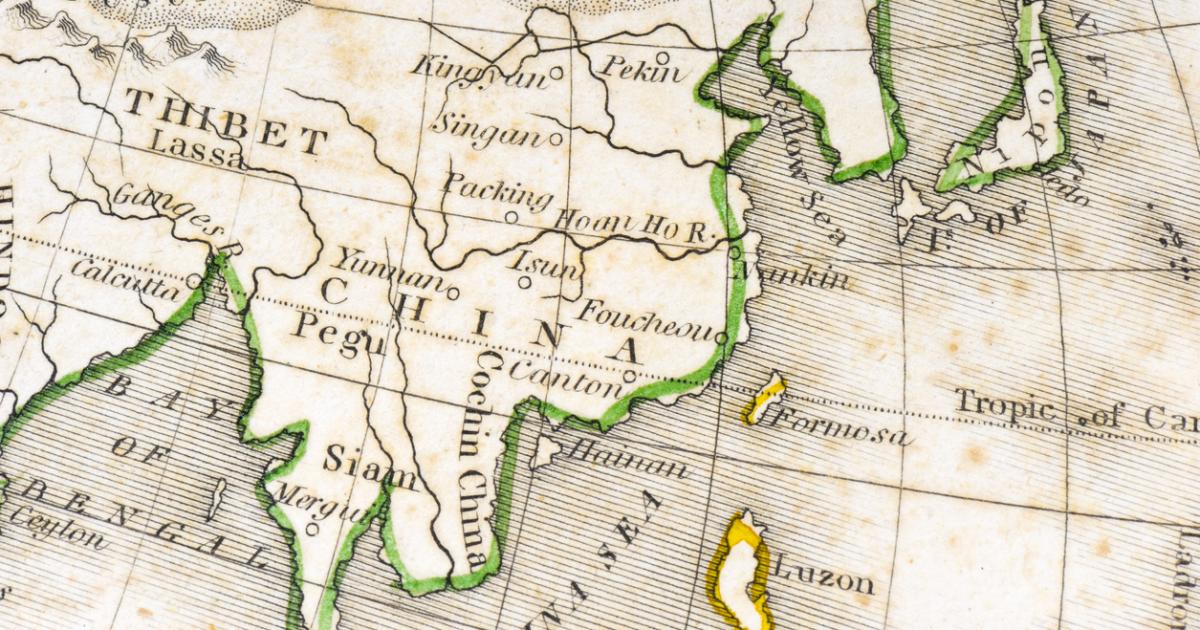

My work examines the evolution of the Chinese monetary system from the Qing Dynasty (1644– 1911) through the Republic Period (1912–1949). During these three centuries, China underwent a commercial revolution. The Qing conquest of Mongolia opened trade routes to Inner Asia and Russia and set the stage for a surge in international commerce. China sent tea and silks abroad in return for furs, mushrooms, and other goods. Migrants followed merchants, and Chinese homesteaders founded new farming communities in the Mongolian hinterland in areas that had formerly been reserved for nomads. Urban hubs and trade entrepots across northern China resounded with the buzz of commerce. But this economic boom, like all economic booms, required money to sustain it. In China, this posed a problem. Hard cash consisted of silver for wholesale transactions and copper for retail transactions. Silver could be shipped to where it was most needed. But copper was bulky, heavy, and low value; shipping it overland across northern China was extremely inefficient. The country faced a predicament: where would it get its money?

In a modern economy, central banks step in to relieve cash shortages by printing money. But in eighteenth-century China there was no central bank. Moreover, numerous attempts by governments throughout Chinese history to issue fiat money had ended in disaster. Memories of hyperinflation in the previous Yuan (1271–1368) and Ming (1368–1644) dynasties loomed large on the thinking of both officialdom and business. The fiscally cautious Qing state was as reluctant to issue a government currency as the merchant community would have been to accept it. The market stepped in to fill the gap. A new source of Chinese money came from what, to modern sensibilities, may seem like an unlikely source: private business.

From the late eighteenth century onward, for-profit merchant enterprises began to print their own scrip to meet the currency needs of local commerce. The most popular form of paper money came from traditional Chinese banks known as qian’pu. These banks were located in major commercial centers. They would issue paper notes that were convertible for copper. That way, when merchants needed ready money, they could go to the bank for a stack of bills instead of hauling around satchels of heavy metal. These bills would then circulate in the market until someone had a need for hard currency. Then, they would go to the bank with note in hand and redeem the slip of paper for physical copper coins.

Outside of urban centers and commercial hubs, an array of institutions issued notes that circulated in the countryside. Grain merchants issued paper money in order to pay for purchases of wheat, buckwheat, millet, beans, and sorghum. These notes were redeemable for hard copper at the grain merchant’s affiliate bank. In even more rural or isolated locations, country general stores issued their own paper notes. General store scrip would not have circulated very far afield, but it was money good in its native village. Urban notes, too, could make their way into the countryside, as banks sent agents or peddlers to do business in rural markets and at rural fairs.

Today, we trust US dollars because they have the full faith and credit of the United States Government. But why would merchants and peasants in nineteenth-century China trust pieces of paper issued by private firms? Public confidence in private notes rested on two pillars. First, the Qing legal system enforced noteholders’ rights in the event of default. Second, a series of voluntary business associations akin to present-day chambers of commerce regulated the conduct of their member firms.

The legal basis of private notes stemmed from Qing law’s strong protection for private contracts and for debt contracts in particular. The Qing legal code gave the state explicit responsibility to enforce debt contracts, at least to the extent that the debtor could truly afford to pay. Qing magisterial courts treated private banknotes as a particular kind of debt contract: i.e., a contract that meant the issuing firm owed the noteholder a certain amount of copper cash. In the event of default, the state preferred to let the private parties work out their differences. A creditor committee would come to an arrangement with the defaulting bank, usually for repayment or partial repayment over an extended period of time. But when no agreement was forthcoming—or worse, if the bank was acting in bad faith or had committed fraud—Qing courts brought the full coercive powers of the state to bear on the defaulting party. Such bankers could have not only their own property but also their family’s property seized by the state to pay restitution. They might also face corporal punishment such as being placed in the stockades or forced to serve long sentences of penal servitude.

The civil basis of private notes derived from voluntary, self-regulating bank associations. These associations would only accept members of sterling reputation and credit. They also performed periodic audits, regulated members’ business activities, and required member banks to keep sufficient reserves to redeem notes in a hurry if the situation required it. Most importantly, these associations operated liquid, interbank overnight markets. This meant that banks that needed a little extra copper to tide them over in the short term could borrow easily at attractive rates. Meanwhile, banks with a little extra cash in hand could lend into the interbank market, and thus not lose out on potential interest income by keeping idle capital. In this way, banks that joined the associations immediately become more solvent; they had access to deep capital markets that other banks lacked. Still, such associations were truly voluntary. Anyone could set up a bank; but without joining the association it would remain a savings and loan, not an issuing bank.

This elaborate system of private money faced serious challenges in the twentieth century. A host of state actors, national and regional, began to issue their own money. They did not take kindly to private competition. The nationalist government of Chiang Kai-shek dealt the most serious blow to private money. Chiang oversaw a set of sweeping centralizing measures meant to rapidly industrialize China and prepare it for what he rightly saw as an inevitable war with Japan. To do this, Chiang required his own fiat currency. His Nationalist Party’s “legal tender” notes gradually replaced other forms of currency.

But China’s system of private money enjoyed one final act. With the onslaught of the Japanese invasion, numerous parts of China were left with only minimal state oversight. Meanwhile, fiat currencies—whether Japanese, Nationalist, or Communist—experienced ruinous inflation. To meet the need for money, the old system of private notes came roaring back. Businesses and other institutions began to print their own notes to meet the demands of local commerce.

China’s fascinating history with private money is more relevant today than ever. Although China, like any other modern economy, now uses a fiat currency (the renminbi), its late-imperial system presages contemporary attempts of private actors to create money. The most sensational of these attempts is cryptocurrency, but it must also include a suite of financial innovations used to extend credit by private actors. It also shows that any sufficiently complex civilization will need sophisticated financial “plumbing” to help it coordinate.

Read the full working paper here.

Matthew Lowenstein is a Hoover Fellow at the Hoover Institution, Stanford University. He studies the economic history of modern China from the late imperial period to the early People’s Republic.

Research briefings highlight the findings of research featured in the Long-Run Prosperity

Working Paper Series and broaden our understanding of what drives long-run economic growth.