- Budget & Spending

- Economics

- Law & Policy

- Regulation & Property Rights

- Monetary Policy

- Economic

- Politics, Institutions, and Public Opinion

- Campaigns & Elections

- Health Care

- History

America’s financial crisis, deep recession, and anemic recovery have been driven largely by economic policies that have deviated from proven, fact-based principles. To return to prosperity, we must get back to these principles.

The most fundamental starting point is that people respond to incentives and disincentives. Tax rates offer a strong example because the data are so clear and the results so powerful. A wealth of evidence shows that high tax rates retard investment and lower productivity growth; raise taxes, and living standards stagnate.

Moreover, when higher taxes reduce the reward for work, you get less of it. Nobel Prize–winning economist Edward Prescott showed this when he examined international labor market data and demonstrated that changes in tax rates on labor are associated with changes in employment and hours worked. From the 1970s to the 1990s, the effective tax rate on work increased by an average of 28 percent in Germany, France, and Italy. Over that same period, work hours fell by an average of 22 percent in those three countries.

Long-lasting economic policies based on a long-term strategy work; temporary policies don’t. The difference between the effects of permanent tax rate cuts and one-time temporary tax rebates is also well documented. The former creates a sustainable increase in economic output, the latter at best only a transitory blip. Temporary policies create uncertainty that dampens economic output as market participants, unsure about whether and how policies might change, delay their decisions.

As Milton Friedman famously observed, nobody spends somebody else’s money as wisely as he spends his own. Having “skin in the game” leads to superior outcomes. When legislators put other people’s money at risk—as when Fannie Mae and Freddie Mac bought risky mortgages—crisis and economic hardship result. When minimal co-payments and low deductibles are mandated in the insurance market, wasteful health care spending balloons.

Rule-based policies provide the foundation of a high-growth market economy. For most of the 1980s and 1990s, monetary policy was conducted in a predictable, rule-like manner that kept the economy stable. We avoided lengthy economic contractions like the Great Depression of the 1930s and the rapid inflation of the 1970s.

Abiding by such policies minimizes capricious discretionary actions such as the recent ad hoc federal bailouts. The history of recent economic policy is one of massive deviations from basic tenets, resulting in a crippling recession and now a weak recovery. The deviations began with policies—as when the Federal Reserve held interest rates too low for too long—that fueled an unsustainable housing boom. Federal housing policies allowed home loans with no money down. Banks were encouraged to make risky loans and securitization separated lenders from their loans. Neither borrower nor lender had sufficient skin in the game. Lax enforcement of existing regulations allowed both investment and commercial banks to circumvent long-established banking rules to take on far too much leverage. Regulators failed, not regulations.

The departures from sound principles continued when the Fed and the Treasury responded with arbitrary and unpredictable bailouts of banks, auto companies, and financial institutions. They financed their actions with unprecedented money creation and massive debt issuance. These frantic moves spooked already turbulent markets and led to financial panic.

More deviations occurred when the government responded with ineffective, temporary stimulus packages. The 2008 tax rebate and the 2009 spending stimulus bills failed to improve the economy. Cash for clunkers and the first-time home buyers' tax credit merely moved purchases forward by a few months.

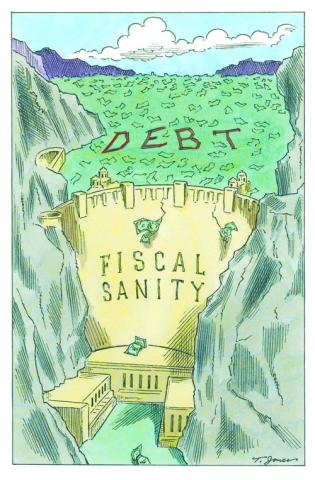

Then came the health care overhaul, which imposes taxes on savings and investment and gives the government control over health care decisions. Fannie Mae and Freddie Mac and their estimated $400 billion cost to taxpayers have been given no path to resolution. Hundreds of new complex regulations lurk in the financial reform bill, with most critical details left to regulators. Uncertainty reigns, and nearly $2 trillion in cash sits in corporate coffers.

Since the financial crisis began, annual federal spending has increased by an extraordinary $800 billion—more than $10,000 for every American family. This has driven the budget deficit to 10 percent of GDP, far above the previous peacetime record. The Obama administration has proposed to lock a sizable portion of that additional spending into government programs and to finance it with higher taxes and debt.

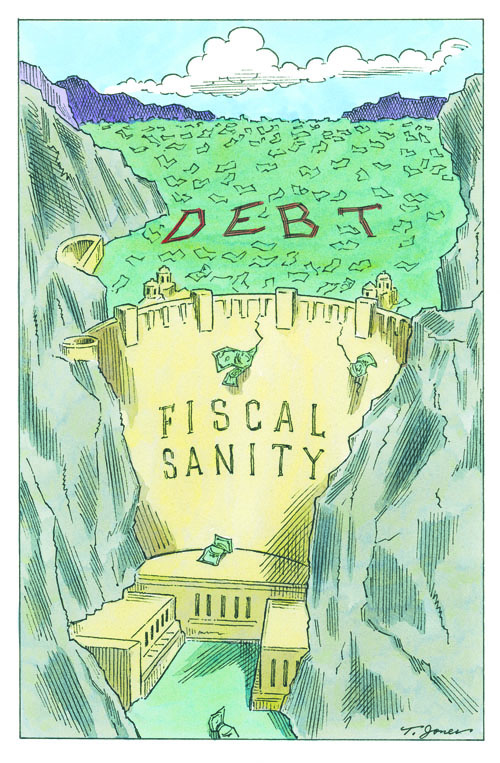

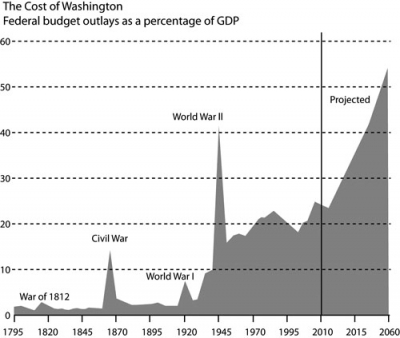

The federal budget is perhaps the best indicator of the destructive path blazed by these policy deviations. The chart on this page puts the fiscal problem in perspective. It shows federal spending as a percentage of GDP, an amount that is now 24 percent, up sharply from 18.2 percent in 2000.

As the chart shows, in all of U.S. history there has been only one period of sustained decline in federal spending relative to GDP: in 1983–2001, spending relative to GDP declined by 5 percentage points. Two factors dominated this remarkable period. First was strong economic growth. Second was modest spending restraint—on domestic spending in the 1980s and on defense in the 1990s.

Future federal spending, driven mainly by retirement and health care promises, is likely to increase beyond 30 percent of GDP in twenty years and then keep rising, according to the Congressional Budget Office. The reckless expansions of both entitlements and discretionary programs in recent years have only added to our long-term fiscal problem.

The good news is that we can change these destructive policies by adopting a strategy based on proven economic principles:

• Take tax increases off the table. Higher tax rates are destructive to growth and would ratify the recent spending excesses. Our complex tax code is badly in need of an overhaul to make America more competitive. For example, the U.S. corporate tax is one of the highest in the world. That’s why many tax reform proposals integrate personal and corporate income taxes with fewer special tax breaks and lower tax rates.

But in the current climate, with the very creditworthiness of the United States at stake, we would keep the present tax regime in place while avoiding the severe economic drag of higher tax rates.

• Balance the federal budget by reducing spending. Publicly held debt must be brought down to the pre-crisis safety zone. To do this, the excessive spending of recent years must be removed before it becomes a permanent budget fixture. The government should begin by rescinding unspent “stimulus” funds, ratcheting down domestic appropriations to their pre-binge levels, and repealing entitlement expansions, most notably the subsidies in the health care bill.

The next step is restructuring public activities between federal and state governments. The federal government has taken on more responsibilities than it can properly manage and efficiently finance. The 1996 welfare reform, which transferred authority and financing for welfare from the federal to the state level, should serve as the model. This reform reduced welfare dependency and lowered costs, benefiting taxpayers and welfare recipients.

• Modify Social Security and health care entitlements to reduce their explosive future growth. Social Security now promises much higher benefits to future retirees than to today’s retirees. The typical thirty-year-old today is scheduled to get an inflation-adjusted retirement benefit that is 50 percent higher than the benefit for a typical current retiree.

Benefits paid to future retirees should remain at the same level, in terms of purchasing power, that today’s retirees receive. A combination of indexing initial benefits to prices rather than to wages and increasing the program’s retirement age would achieve this goal. They should be phased in gradually so that current retirees and those nearing retirement are not affected.

Health care is far too important to the American economy to be left in its current state. In markets other than health care, the legendary American shopper, armed with money and information, has kept quality high and costs low. In health care, service providers, unaided by consumers with sufficient skin in the game, make the purchasing decisions. Third-party payers—employers, governments, and insurance companies—have resorted to regulatory schemes and price controls to stem the resulting cost growth.

The key to making Medicare affordable while maintaining the quality of health care is more patient involvement, more choices among Medicare health plans, and more competition. Co-payments should be raised to make patients and their physicians more cost-conscious. Monthly premiums should be lowered to provide seniors with more disposable income to make these choices. A menu of additional Medicare plans, some with lower premiums, higher co-payments, and improved catastrophic coverage, should be added to the current one-size-fits-all program to encourage competition.

For Medicaid, modest co-payments should be introduced (except for preventive services). The program should be turned over entirely to the states with federal financing supplied by a “no strings attached” block grant. States should then allow Medicaid recipients to purchase a health plan of their choosing with a risk-adjusted Medicaid grant that phases out as income rises.

The 2010 health care law undermined reforms under way since the late 1990s, including higher co-payments and health savings accounts. The law should be repealed before its regulations and price controls further damage the availability and quality of care. It should be replaced with policies that target specific health market concerns: quality, affordability, and access. Making out-of-pocket expenditures and individual purchases of health insurance tax-deductible, enhancing health savings accounts, and improving access to medical information are keys to more consumer involvement. Allowing consumers to buy insurance across state lines will lower the cost of insurance.

• Enact a moratorium on all new regulations for the next three years, with an exception for national security and public safety. Regulations should be transparent and simple, pass rigorous cost-benefit tests, and rely to a maximum extent on market-based incentives instead of command and control. Direct and indirect cost estimates of regulations and subsidies should be published before new regulations are put into law.

Off-budget financing should be ended by closing Fannie Mae and Freddie Mac. The Bureau of Consumer Finance Protection and all other government agencies should be on the budget that Congress annually approves. An enhanced bankruptcy process for failing financial firms should be enacted to end the need for bailouts. Higher bank capital requirements that rise with the size of the bank should be phased in.

• Make monetary policy less discretionary and more rule-like. The Federal Reserve should announce and follow a monetary policy rule, such as the Taylor rule, in which the short-term interest rate is determined by the supply and demand for money and is adjusted through changes in the money supply when inflation rises above or falls below the target, or when the economy goes into a recession. When monetary policy decisions follow such a rule, economic stability and growth increase.

To reduce the size of the Fed’s bloated balance sheet without causing more market disruption, the Fed should announce and follow a clear and predictable exit rule, which describes a contingency path for bringing bank reserves back to normal levels. It should also announce and follow a lender-of-last-resort rule designed to protect the payment system and the economy—not failing banks. Such a rule would end the erratic bailout policy that leads to crises.

The United States should, along with other countries, agree to a target for inflation to increase expected price stability and exchange-rate stability. A new accord between the Federal Reserve and Treasury should re-establish the Fed’s independence and accountability so that it is not called upon to monetize the debt or engage in credit allocation. A monetary rule is a requisite for restoring the Fed’s independence.

These pro-growth policies provide the surest path back to prosperity.