Click here to download this proposal.

The “original sin” of healthcare policy—the federal tax preference for employer-sponsored insurance (ESI) premiums—produced the third-party payment system that wreaks havoc on consumer incentives. The tax preference for employer-sponsored plans extends to both federal income and payroll taxes, sheltering employees from viewing the full cost of their coverage. Tax-advantaged ESI plans with high premiums and low out-of-pocket (OOP) spending give people little reason to consider the marginal cost of their care. The tax break is the big reason why the market for healthcare doesn’t look like any other good or service. It also explains why patients see prices after they receive healthcare—not before. Finally, the tax break is regressive: individuals in higher tax brackets derive more savings than those in low tax brackets.

Rather than limiting the existing tax break, the Choices for All Project proposes extending tax deductibility to all out-of-pocket medical spending. The deduction would reduce a tax filer’s adjusted gross income, mirroring the income tax treatment of employer-sponsored insurance (ESI) premiums. This change would curb incentives for purchasing high-premium ESI plans and give people more control over their healthcare spending. It would reduce the backward incentives embedded in the nation’s tax code without raising anyone’s taxes.

Key Plan Elements

- Replace the existing tax deduction for OOP spending with an “above-the-line” deduction.

- Make the deduction available to taxpayers regardless of their income or whether they itemize their deductions.

- Reduce the bias in the tax code favoring the selection of high-premium ESI plans.

- Maintain existing ESI and self-employed premium tax preferences.

- Begin to level the income tax treatment between premiums and OOP payments (but maintain payroll tax exclusion only for premiums).

Details

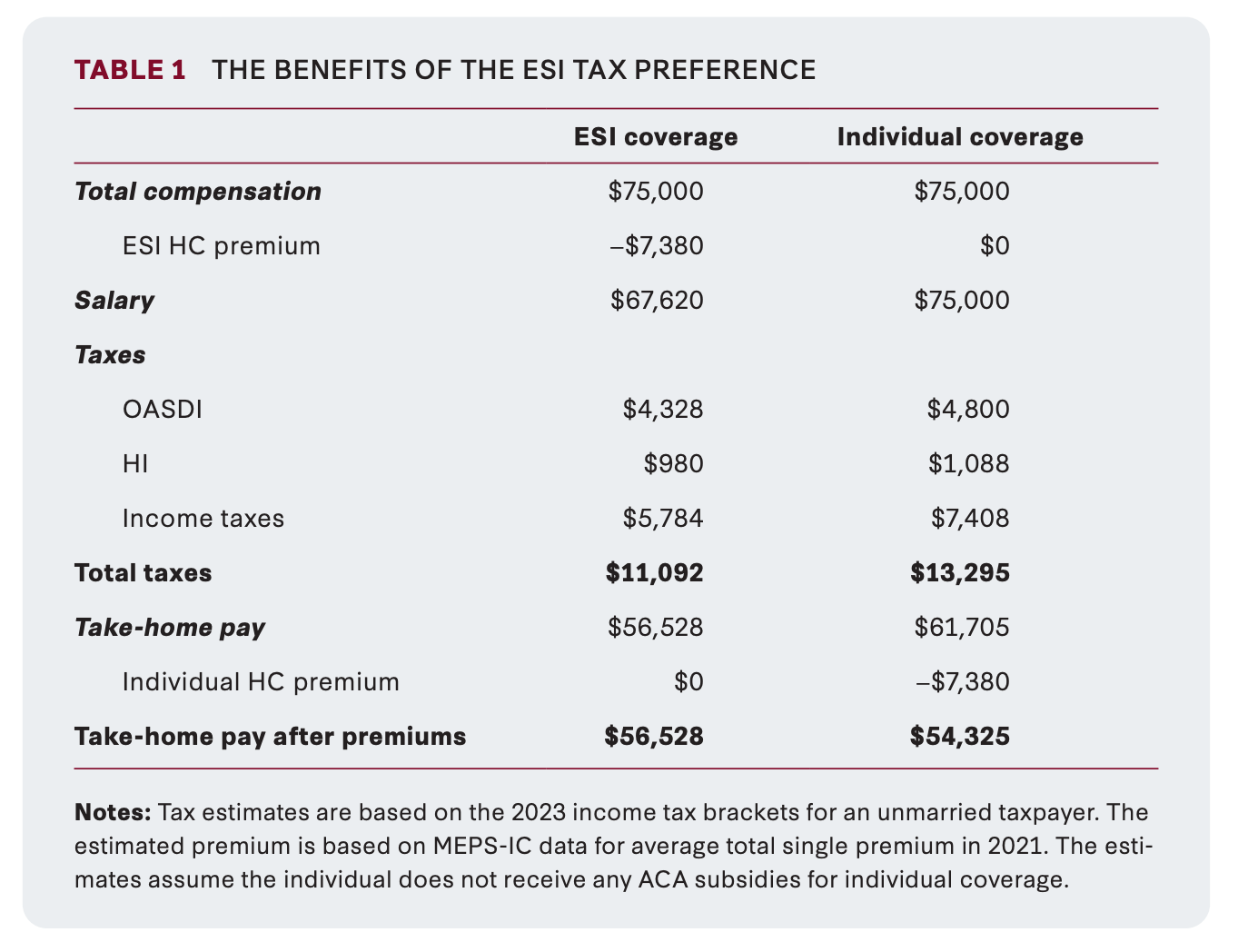

Our tax system does the heavy lifting when it comes to subsidizing most Americans’ healthcare. Since 1954, income spent on ESI premiums has not been subject to federal income or payroll taxes. Table 1 below shows how the current tax preference works. In our simplified example, an unmarried worker has the option of a health insurance plan sponsored by her employer or a plan purchased on the individual market. We assume the premiums are same, but the only difference is where the plan is purchased. As the table shows, the worker would save over $2,000 by buying insurance through her employer.

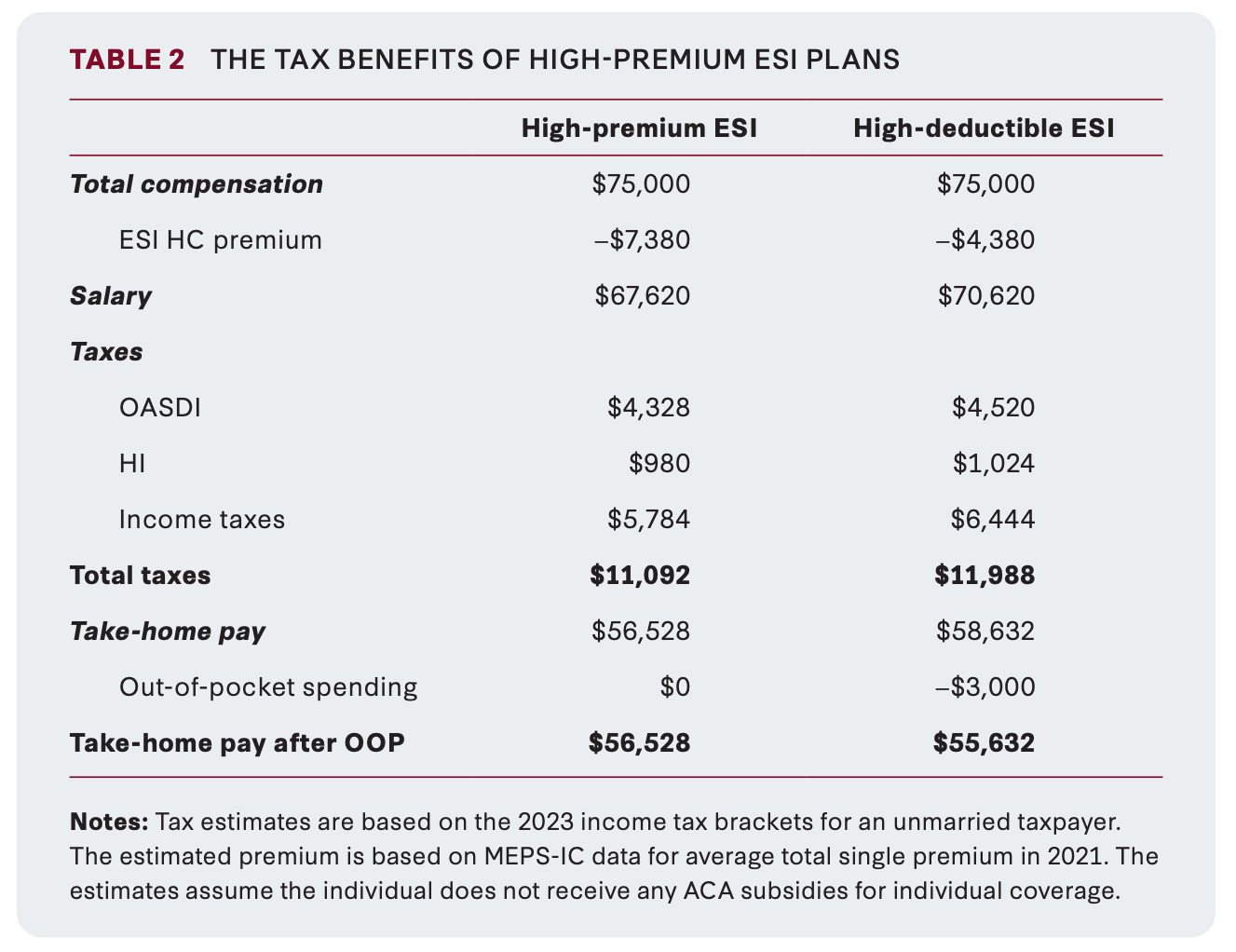

Table 2 presents a stylized example where the same individual with ESI coverage in table 1 can purchase a high-premium plan with no cost sharing or a low-premium plan with a high deductible. For every $1 reduction in premiums in the example, deductibles rise by $1 so the only difference between the two plans is federal tax policy. In the example, picking a plan with a $3,000 deductible reduces income by $900 after accounting for taxes and OOP spending.

The federal tax code encourages workers to choose high-premium ESI plans, which in turn give them more reason to increase their healthcare spending. That is a recipe for a costly, inefficient medical system.

If we want to empower patients, we need to give them incentives to think about the costs and benefits of their medical decisions. Rather than forcing filers to itemize their medical deductions, we should allow taxpayers to deduct their OOP spending when calculating their adjusted gross income. In tax parlance, this is called an “above-the-line” deduction.

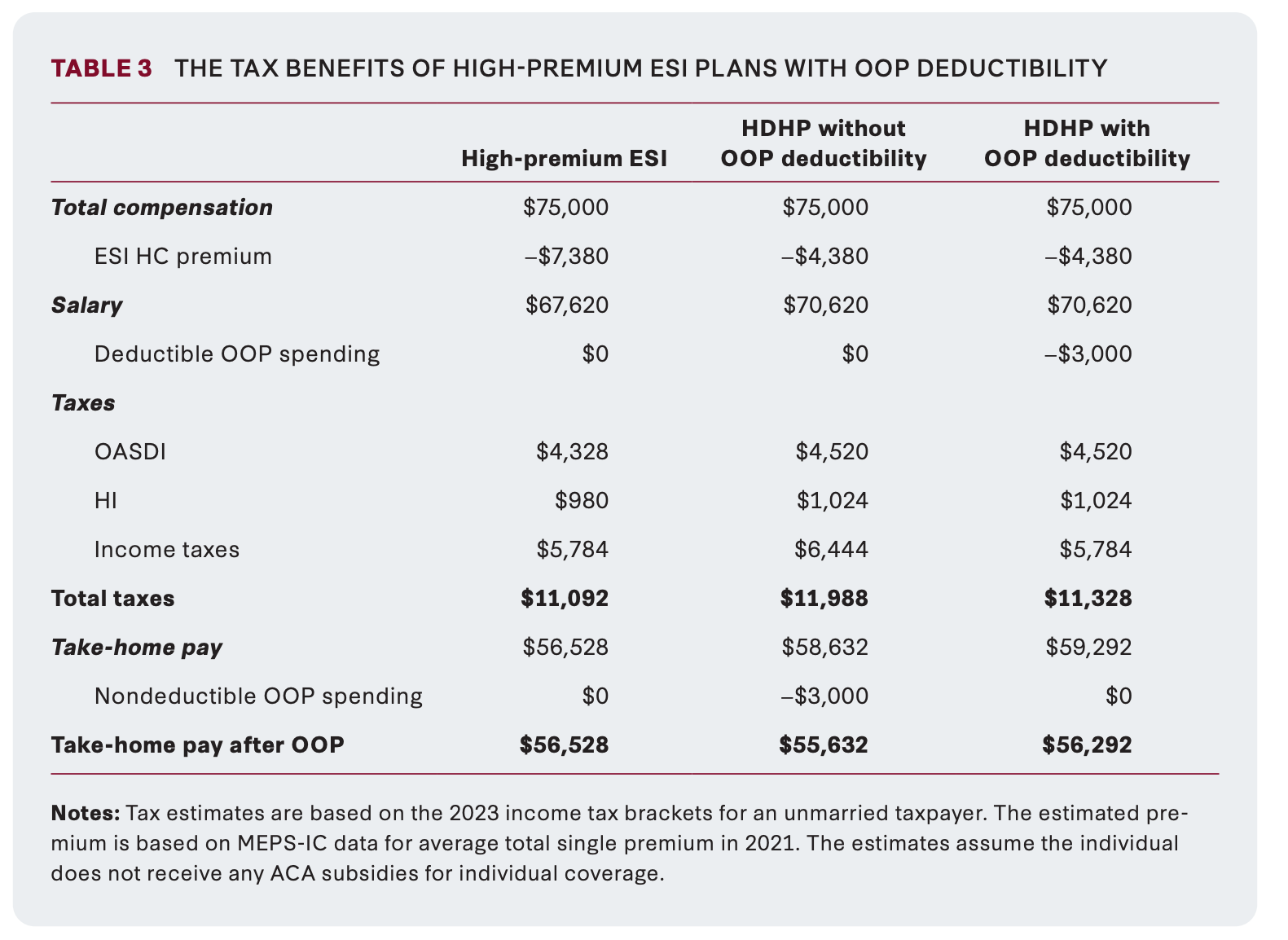

Table 3 shows how this tax change affects our stylized example presented in table 2 above. Making all OOP spending deductible increases the take-home pay after OOP spending for people who purchase high-deductible health plans (HDHP). The change only affects their income tax liability. With the new deduction, our taxpayer reduces her income taxes by $660. The most important takeaway from this table: the difference between a high-premium ESI plan and HDHP plan is significantly reduced. In our example, the tax benefit from choosing the high-premium plan falls from $896 to $236.

Paired with our proposed universal IHA accounts, the logistics of keeping track of out-of-pocket medical spending would mirror those used by Health Savings Account (HSA) holders. HSA account holders regularly pay for out-of-pocket spending with account-specific debit cards. The financial institutions that manage their HSAs are required to send end-of-year tax forms that report their qualified medical spending. Expanding the deductibility of OOP spending would be much simpler than the existing system of only deducting when spending is above 7.5 percent of a filer’s AGI.

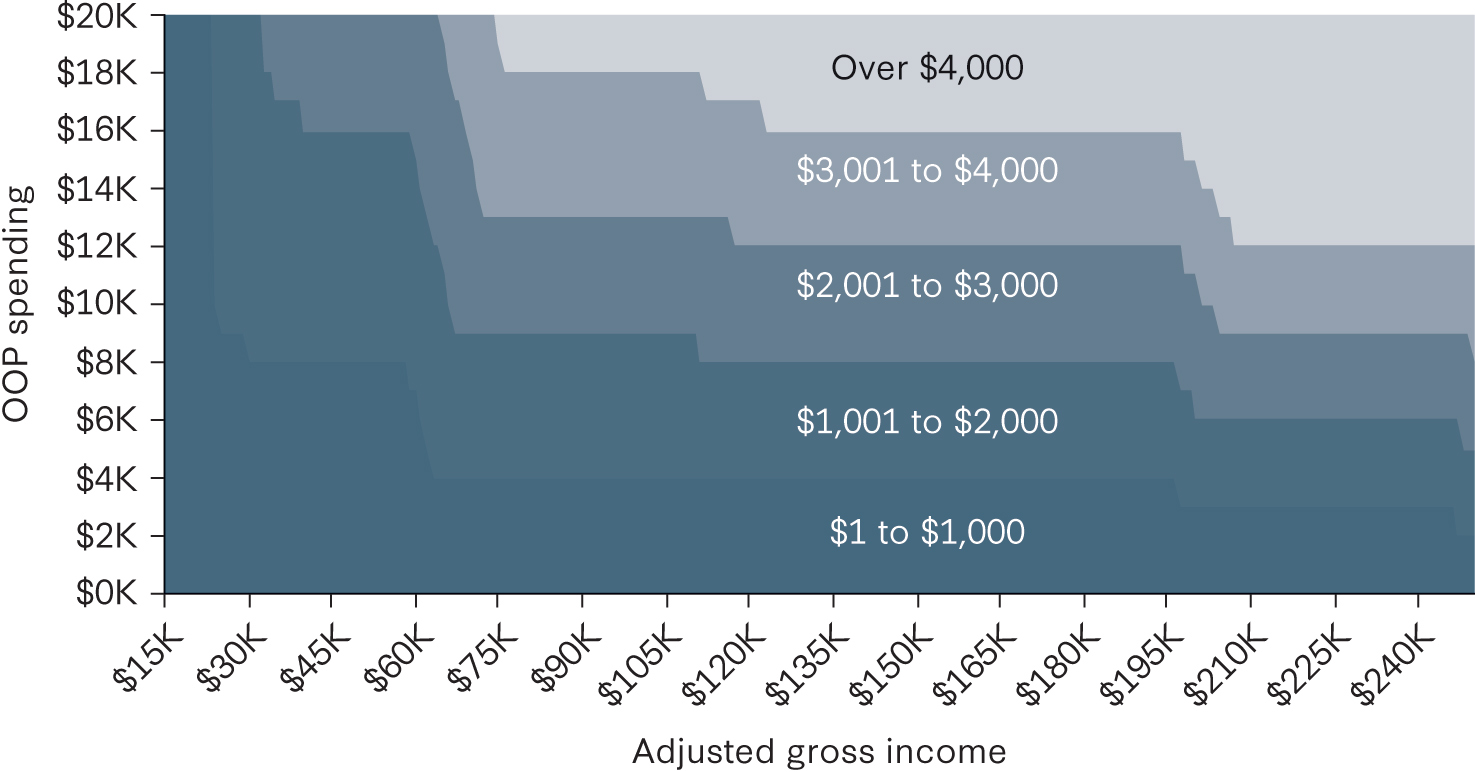

Beyond reducing the relative tax preference for ESI premiums, moving the deduction “above the line” also avoids the need to itemize. This ensures two taxpayers with similar incomes and medical expenses receive comparable tax savings from the deduction regardless of whether they itemize. This is significant because more than 90 percent of taxpayers did not itemize their deductions in 2020. Figure 1 shows the potential tax savings of the new deduction by income and OOP spending.

We estimate that after accounting for dynamic effects, expanding OOP deductibility would reduce federal tax revenues by $79 billion over ten years. Income tax revenues would fall by $167 billion but payroll tax revenue would rise by $88 billion. For more information, see our cost estimates.