Today, Condoleezza Rice and other Hoover scholars share policy insights and career advice with visiting student advocates for school choice; Elizabeth Economy argues that an “America First” approach is keeping the White House from crafting a coherent strategy toward China; and Lee Ohanian reviews ongoing governance and policy challenges in Los Angeles.

Reforming K–12 Education

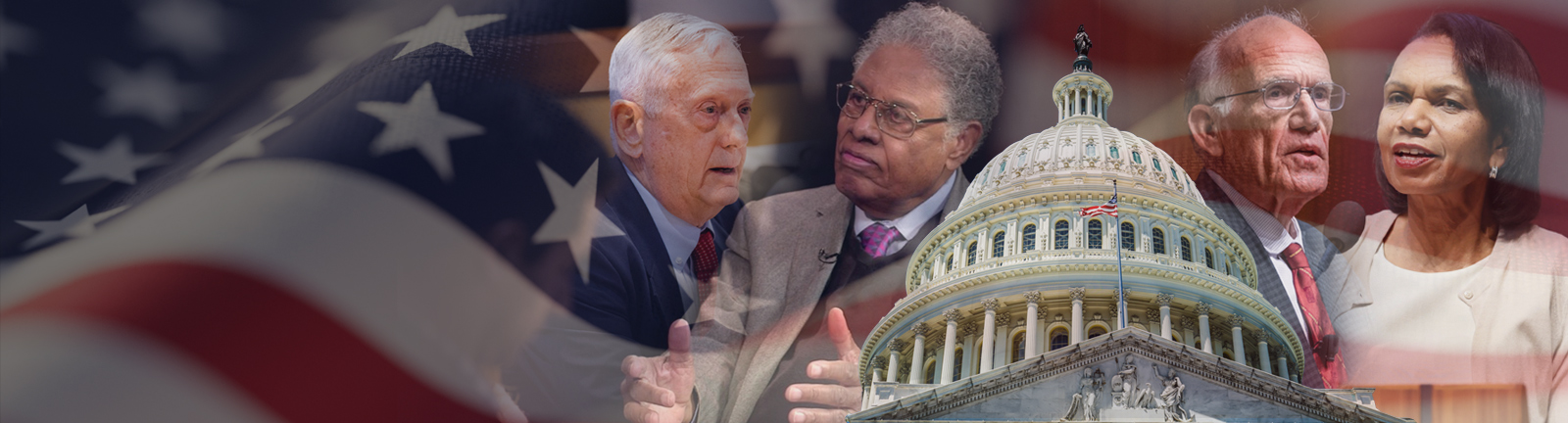

A group of students who demonstrate how school choice propels pupils to dream bigger got to hear from an all-star lineup of distinguished speakers at the Hoover Institution earlier this month. The ten students spoke to Hoover fellows, a successful start-up cofounder, a Space Force officer, and Director Condoleezza Rice about pathways to career excellence and the experiences, traits, and skills learned outside the classroom that prepare young people for success. The visiting students were all affiliated with the American Federation for Children Growth Fund, a nonprofit education organization that empowers families with educational freedom. Its fellowship program offers a year-long mentorship and leadership opportunity to US pupils who completed K–12 education through a publicly funded school choice program or have received a private school choice scholarship. Read more here.

Freedom Frequency

Writing at Freedom Frequency, Senior Fellow Elizabeth Economy discusses the Trump administration’s “America First” approach, saying it neglects the strategy the United States needs for a coherent stance toward China. Lacking that strategy has brought a global tariff war that’s strengthened China’s hand, has reduced cooperation with allies, and has tugged policy in contradictory directions. A narrow vision of US leadership, she writes, surrenders global leadership to China in critical areas while weakening the American voice for democracy and human rights. Economy also gives a brisk video overview of timely China issues here, in a video feature called China Considered Quick Takes. Read more here.

California Policy and Politics

In a new column at California on Your Mind, Senior Fellow Lee Ohanian analyzes the state of governance in Los Angeles. As he writes, “When governance is effective, disasters expose heroism, fast response, minimal damage to life and property, and rapid recovery. When it is poorly managed, disorganized, and ineffective, disasters expose enormous deficiencies that turn what should be contained into unprecedented calamities.” Ohanian finds that Los Angeles unfortunately demonstrates the latter case, citing the city’s uncoordinated response to the Palisades Fire and ongoing challenge with homelessness, an issue on which the city “is spending a lot, and may be losing some of that spending to fraud.” Ohanian concludes that “Angelenos should be receiving so much more from the local governments they fund,” and that improved governance will require voters selecting more effective political leadership. Read more here.

Determining America’s Role in the World

Senior Fellow H.R. McMaster joined The Guy Benson Show yesterday to discuss President Trump’s continued disruption of international norms and why McMaster believes that disruption has led to historic results in his second term. McMaster highlights Trump’s policy accomplishments on border security, US energy independence, and renewed pressure on Iran, as well as the successful return of hostages from Hamas captivity to their homes in Israel, as key successes of the current term. McMaster also weighed in on the President’s decision to militarily strike cartel boats allegedly smuggling drugs, saying he supports the mission but believes there must be “more transparency” around the strategy. Finally, McMaster closes by discussing the ongoing war in Ukraine, and why now, he says, is the moment to call Putin’s bluff. Listen here.

Economics and Finance

On the latest episode of Capitalism and Freedom in the Twenty-First Century, Policy Fellow Jon Hartley interviews distinguished investor and financial scholar Cliff Asness. Asness shares insights from his time as a graduate student under Eugene Fama at the University of Chicago, his career at Goldman Sachs, and founding AQR Capital Management, the investment firm where he serves as managing principal and chief investment officer. Hartley and Asness discuss factor-based investing (or, investing based on value and momentum), the efficient markets hypothesis, the elastic markets hypothesis, and the inelastic markets hypothesis. The conversation also touches on differences between private equity and public equity returns, among other topics. Read more here.

Related Commentary